Regulatory Support and Transparency

The Exchange Traded Fund Market benefits from a favorable regulatory environment that promotes transparency and investor protection. Regulatory bodies have implemented measures to enhance the disclosure of information related to ETFs, ensuring that investors have access to essential data for informed decision-making. This increased transparency fosters trust among investors, encouraging participation in the ETF market. In recent years, regulatory frameworks have evolved to accommodate innovative ETF structures, such as actively managed ETFs and non-transparent ETFs. These developments indicate a commitment to supporting the growth of the Exchange Traded Fund Market while safeguarding investor interests. As regulations continue to adapt to market dynamics, the industry is likely to attract a broader range of investors, further bolstering its expansion.

Increased Institutional Participation

The Exchange Traded Fund Market is experiencing a marked increase in institutional participation. Institutional investors, including pension funds, endowments, and insurance companies, are increasingly allocating capital to ETFs as part of their investment strategies. In 2025, institutional assets in ETFs are estimated to account for over 40% of total ETF assets, underscoring the growing acceptance of ETFs among large investors. This trend is driven by the cost-effectiveness, liquidity, and transparency that ETFs offer compared to traditional investment vehicles. Additionally, institutions are leveraging ETFs for various purposes, including hedging, asset allocation, and exposure to niche markets. As institutional participation continues to rise, the Exchange Traded Fund Market is likely to benefit from enhanced credibility and stability, further attracting retail investors.

Rising Investor Demand for Diversification

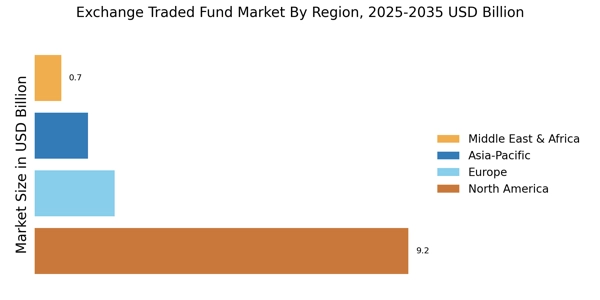

The Exchange Traded Fund Market experiences a notable increase in investor demand for diversification. Investors are increasingly seeking to mitigate risks associated with concentrated portfolios. ETFs provide a mechanism for achieving broad market exposure, allowing investors to access various asset classes, sectors, and geographies. In 2025, the total assets under management in ETFs reached approximately 10 trillion USD, reflecting a growing preference for diversified investment strategies. This trend is likely to continue as more investors recognize the benefits of diversification in their portfolios. Furthermore, the ability to trade ETFs throughout the day adds to their appeal, as investors can react swiftly to market changes. As a result, the Exchange Traded Fund Market is poised for sustained growth, driven by this rising demand for diversified investment solutions.

Growing Popularity of Sustainable Investing

The Exchange Traded Fund Market is witnessing a surge in the popularity of sustainable investing. Investors are increasingly prioritizing environmental, social, and governance (ESG) factors in their investment decisions. In 2025, assets in ESG-focused ETFs are projected to exceed 2 trillion USD, reflecting a growing commitment to sustainable investment practices. This trend is driven by a combination of consumer demand for responsible investing and institutional pressure to adopt sustainable strategies. As more investors seek to align their portfolios with their values, the Exchange Traded Fund Market is likely to see an influx of new products catering to this demand. Furthermore, the integration of ESG criteria into investment strategies may enhance long-term performance, making sustainable ETFs an attractive option for a diverse range of investors.

Technological Advancements in Trading Platforms

The Exchange Traded Fund Market is significantly influenced by technological advancements in trading platforms. The proliferation of online brokerage services and mobile trading applications has democratized access to ETFs, enabling a wider audience to participate in the market. In 2025, it is estimated that over 70% of ETF trades occur through digital platforms, highlighting the shift towards technology-driven trading solutions. These platforms often provide advanced analytical tools, real-time data, and educational resources, empowering investors to make informed decisions. Additionally, the integration of artificial intelligence and machine learning in trading algorithms may enhance trading efficiency and execution speed. Consequently, the Exchange Traded Fund Market is likely to experience increased trading volumes and heightened investor engagement as technology continues to reshape the investment landscape.