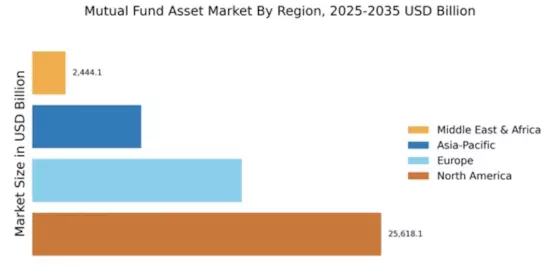

North America : Market Leader in Assets

North America continues to lead the Mutual Fund Asset Market, holding a significant market share of 25618.1 million. The region's growth is driven by increasing investor confidence, a robust regulatory framework, and a diverse range of investment options. The demand for mutual funds is bolstered by rising disposable incomes and a growing awareness of investment benefits among the population. Regulatory support, including tax incentives for retirement accounts, further catalyzes market expansion.

The competitive landscape in North America is characterized by the presence of major players such as BlackRock, Vanguard Group, and Fidelity Investments. These firms dominate the market, offering a wide array of mutual fund products tailored to various investor needs. The U.S. remains the leading country, with a well-established financial infrastructure that supports mutual fund growth. The ongoing trend towards digital investment platforms is also reshaping the market dynamics, making it more accessible to retail investors.

Europe : Emerging Investment Hub

Europe's Mutual Fund Asset Market is witnessing significant growth, with a market size of 15374.0 million. The region benefits from a strong regulatory environment that encourages investment in mutual funds, alongside increasing demand for diversified investment options. Factors such as low-interest rates and economic recovery post-pandemic are driving investors towards mutual funds as a viable alternative for wealth accumulation. The European market is also adapting to sustainable investment trends, which are becoming increasingly important for investors.

Leading countries in this region include Germany, France, and the UK, where major players like Amundi and Legal & General Investment Management are prominent. The competitive landscape is evolving, with a growing number of asset managers entering the market to cater to diverse investor preferences. The European Securities and Markets Authority emphasizes the importance of transparency and investor protection, which is crucial for maintaining market integrity and fostering investor confidence.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is emerging as a significant player in the Mutual Fund Asset Market, with a market size of 8000.0 million. The growth is driven by increasing urbanization, rising disposable incomes, and a growing middle class that is more inclined to invest in mutual funds. Regulatory reforms aimed at enhancing market accessibility and investor protection are also contributing to this growth. The region is witnessing a shift towards digital platforms, making mutual funds more accessible to a broader audience.

Countries like China, India, and Australia are leading the charge in this market. The competitive landscape features both local and international players, with firms like Invesco and T. Rowe Price expanding their presence. The demand for innovative investment products tailored to local preferences is on the rise, and asset managers are increasingly focusing on ESG (Environmental, Social, and Governance) criteria to attract socially conscious investors.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) region is gradually developing its Mutual Fund Asset Market, currently valued at 2444.1 million. The growth is fueled by increasing financial literacy and a shift towards investment diversification among local investors. Regulatory bodies are working to enhance the investment climate, promoting mutual funds as a viable investment option. The region's economic diversification efforts are also encouraging investments in mutual funds, particularly in emerging markets.

Leading countries in this region include South Africa and the UAE, where local asset managers are gaining traction. The competitive landscape is characterized by a mix of traditional and modern investment approaches, with firms adapting to local market needs. The presence of international players is also growing, as they seek to tap into the region's potential. The Financial Services Regulatory Authority emphasizes the importance of investor education to foster a more robust mutual fund market.