Growing Focus on Rare Diseases

The Investigational New Drug CDMO Market is experiencing a heightened focus on the development of therapies for rare diseases. This shift is driven by an increasing recognition of the unmet medical needs in this area, prompting pharmaceutical companies to invest in research and development for orphan drugs. In recent years, the number of IND applications for rare diseases has surged, reflecting a growing commitment to addressing these challenges. CDMOs are essential partners in this endeavor, as they provide the specialized knowledge and capabilities required to navigate the complexities of developing investigational new drugs for rare conditions. As this trend continues, the demand for CDMO services is likely to increase, supporting the overall growth of the market.

Expansion of Personalized Medicine

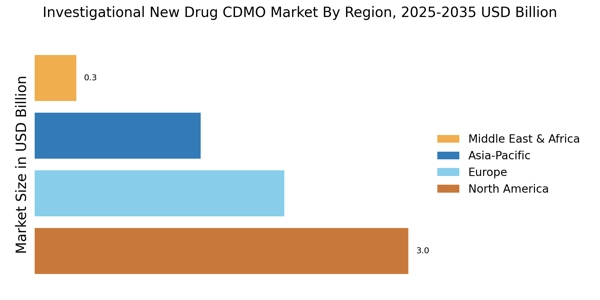

The Investigational New Drug CDMO Market is witnessing a notable shift towards personalized medicine, which is reshaping the landscape of drug development. As the understanding of genetic and molecular factors in diseases advances, there is a growing need for tailored therapies that address specific patient populations. This trend is reflected in the increasing number of IND applications for personalized therapies, which have risen by over 30% in recent years. CDMOs play a pivotal role in this transformation by providing the necessary expertise and infrastructure to develop and manufacture these specialized drugs. Consequently, the demand for CDMO services is likely to expand as pharmaceutical companies seek partners capable of navigating the complexities of personalized medicine.

Regulatory Support for Drug Approvals

The Investigational New Drug CDMO Market benefits from an evolving regulatory landscape that increasingly supports faster drug approvals. Regulatory agencies are implementing streamlined processes and providing guidance to facilitate the development of new therapies. For instance, the FDA has introduced initiatives aimed at expediting the review of IND applications, which can significantly reduce time-to-market for new drugs. This regulatory support is crucial for CDMOs, as it encourages pharmaceutical companies to engage their services for investigational new drug development. As a result, the demand for CDMO services is expected to grow, driven by the need for compliance with these evolving regulations while maintaining high-quality standards.

Increasing Investment in Drug Development

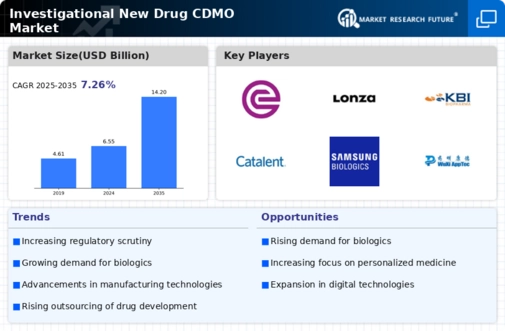

The Investigational New Drug CDMO Market is experiencing a surge in investment as pharmaceutical companies seek to expedite the drug development process. This trend is driven by the increasing complexity of drug formulations and the need for specialized manufacturing capabilities. In 2025, the global pharmaceutical R&D expenditure is projected to reach approximately 200 billion USD, indicating a robust commitment to innovation. As companies allocate more resources to research and development, the demand for contract development and manufacturing organizations (CDMOs) that can support investigational new drug (IND) processes is likely to rise. This investment not only enhances the capabilities of CDMOs but also fosters collaborations that can lead to more efficient drug development pathways.

Technological Advancements in Manufacturing

The Investigational New Drug CDMO Market is significantly influenced by technological advancements in manufacturing processes. Innovations such as continuous manufacturing, automation, and advanced analytics are enhancing the efficiency and quality of drug production. These technologies enable CDMOs to optimize their operations, reduce costs, and improve turnaround times for investigational new drug development. In 2025, it is estimated that the adoption of advanced manufacturing technologies could lead to a 20% reduction in production costs for CDMOs. As pharmaceutical companies increasingly seek cost-effective and efficient solutions, the demand for CDMO services that leverage these technological advancements is expected to grow, further driving the market.