Interactive Display Size

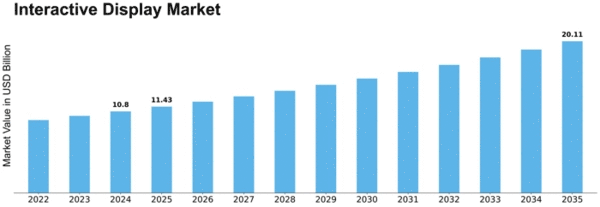

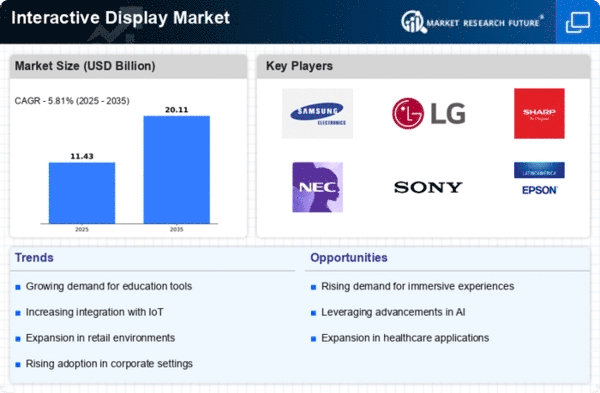

Interactive Display Market Growth Projections and Opportunities

The mounting need for interactive displays in schools is a major factor propelling market growth." An increase in digital learning methods and the focus on fun and dynamic learning tools have made interactive displays very popular in schools and colleges. The need for dynamic displays keeps going up as schools all over the world try to make their classrooms more modern. There are many tools that businesses need to work together and talk to each other. Interactive displays are becoming more and more popular in businesses because they help teams work together and make better presentations. Businesses use interactive displays because they help people talk and share ideas better when they can connect with material in real time during meetings and events. There are also a lot of end users in the interactive display market. This is because medical training and patient education are becoming more popular. Healthcare is using interactive displays because doctors need better ways to see things and because interactive learning material helps patients understand better. The need for engaging displays that make shopping better will grow as the retail business changes. Stores are using digital displays to make the experience of shopping more personal and engaging. Customers can look at goods, get information, and make smart choices thanks to these displays. This makes shopping more fun and rewarding. The need for dynamic displays will grow as the shopping business changes. One of the main things that drives the ongoing development of dynamic display options is growth in technology. The user experience is better now that touch and motion recognition tools are better. Along with interconnected devices and the Internet of Things (IoT), the move toward smart settings is another thing that impacts the market for interactive displays. When you combine interactive displays with the IoT environment, you can use data to get smart apps and insights in shops, businesses, and schools. This factor shows how society is moving toward more digital merging and connection, which is good for the market for interactive displays. As the market grows, there are some good things about it. However, many people find it hard to use because it costs a lot and needs skilled workers. This is very important for groups and companies that don't have a lot of money. The interactive display market needs to fix these issues so it can keep growing and include everyone.

Leave a Comment