Market Growth Projections

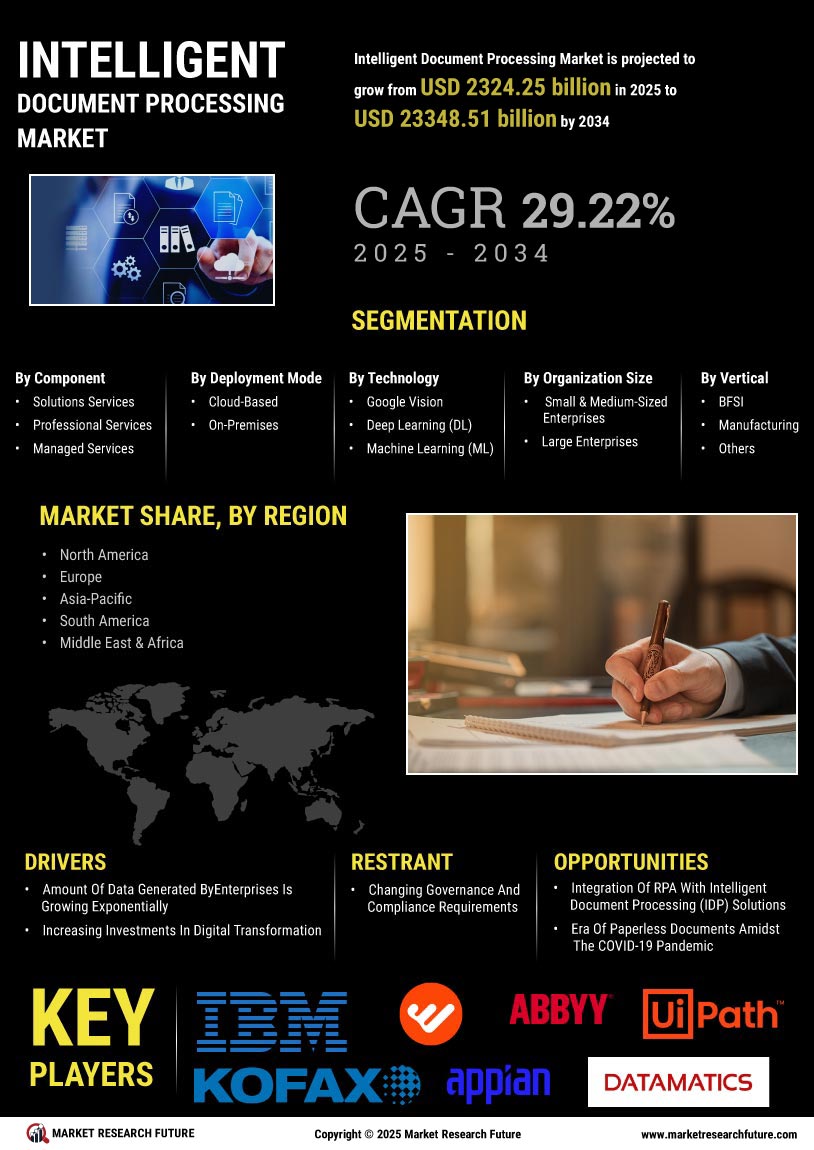

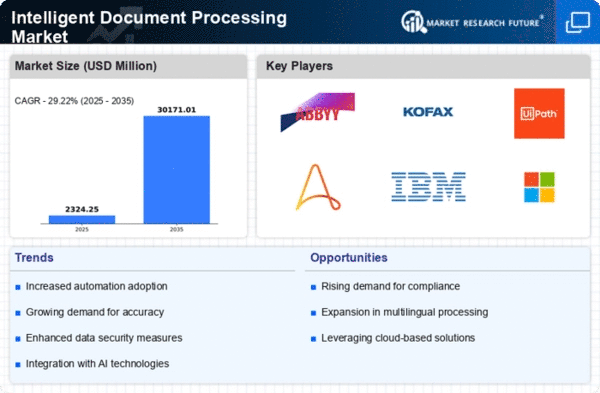

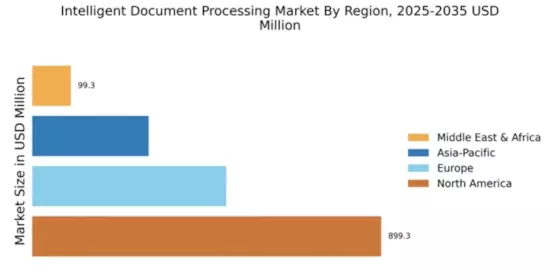

The Global Intelligent Document Processing Market Industry is projected to experience remarkable growth in the coming years. With an anticipated market size of 1.79 USD Billion in 2024, the industry is expected to expand significantly, reaching 30.2 USD Billion by 2035. This growth trajectory indicates a robust compound annual growth rate of 29.26% from 2025 to 2035. Such projections underscore the increasing reliance on intelligent document processing solutions across various sectors, driven by the need for enhanced efficiency, accuracy, and compliance in document management.

Rising Demand for Automation

The Global Intelligent Document Processing Market Industry is experiencing a surge in demand for automation solutions. Organizations are increasingly seeking to streamline their operations and enhance productivity by automating document handling processes. This trend is driven by the need to reduce manual errors and improve efficiency. For instance, businesses that implement intelligent document processing solutions can potentially reduce processing times by up to 80%. As a result, the market is projected to grow from 1.79 USD Billion in 2024 to an impressive 30.2 USD Billion by 2035, reflecting a compound annual growth rate of 29.26% from 2025 to 2035.

Increased Regulatory Compliance

The Global Intelligent Document Processing Market Industry is significantly influenced by the growing emphasis on regulatory compliance across various sectors. Organizations are required to adhere to stringent regulations regarding data management and documentation. Intelligent document processing solutions assist in ensuring compliance by automating the extraction and validation of critical data from documents. This capability not only mitigates risks associated with non-compliance but also enhances the accuracy of reporting. As regulatory frameworks evolve, the demand for intelligent document processing technologies is likely to rise, further propelling market growth.

Growing Adoption of Cloud-Based Solutions

The Global Intelligent Document Processing Market Industry is witnessing a notable shift towards cloud-based solutions. Organizations are increasingly adopting cloud technologies to enhance scalability, accessibility, and collaboration in document processing. Cloud-based intelligent document processing solutions offer the flexibility to manage documents from anywhere, facilitating remote work and improving overall efficiency. This trend is particularly relevant in the context of organizations seeking to reduce infrastructure costs while maintaining robust document management capabilities. As cloud adoption continues to rise, the demand for intelligent document processing solutions is likely to expand, contributing to the market's growth trajectory.

Expansion of Digital Transformation Initiatives

The Global Intelligent Document Processing Market Industry is closely linked to the broader trend of digital transformation initiatives undertaken by organizations worldwide. As businesses increasingly adopt digital technologies, the need for efficient document processing solutions becomes paramount. Intelligent document processing enables organizations to digitize, classify, and extract information from documents seamlessly. This transition not only enhances operational efficiency but also supports data-driven decision-making. With the global push towards digitalization, the market for intelligent document processing is expected to witness substantial growth, driven by the need for organizations to remain competitive in a rapidly evolving landscape.

Integration of Artificial Intelligence and Machine Learning

The Global Intelligent Document Processing Market Industry is significantly shaped by the integration of artificial intelligence and machine learning technologies. These advancements enable intelligent document processing solutions to learn from data patterns, improving accuracy and efficiency in document handling. AI-driven solutions can automatically classify documents, extract relevant information, and adapt to changing data inputs over time. This capability not only enhances operational efficiency but also reduces the need for manual intervention. As organizations increasingly recognize the value of AI and machine learning in document processing, the market is poised for substantial growth.