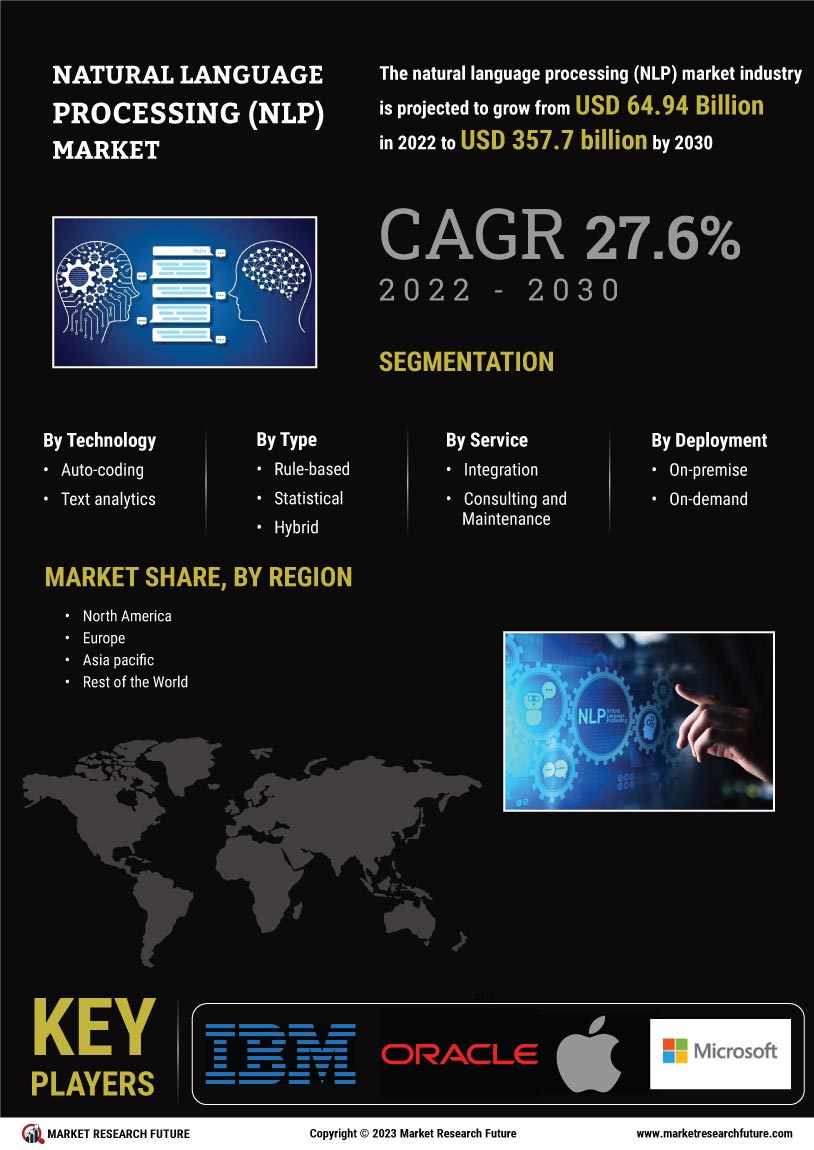

Increased Investment in NLP Startups

The Natural Language Processing Market is experiencing a wave of investment in startups focused on NLP technologies. Venture capitalists and private equity firms are increasingly recognizing the potential of NLP to transform industries such as healthcare, finance, and customer service. Recent data indicates that funding for NLP startups has surged, with investments reaching hundreds of millions of dollars in the past year alone. This influx of capital is fostering innovation and accelerating the development of cutting-edge NLP solutions. As these startups bring novel applications to market, they are likely to contribute to the overall growth and diversification of the Natural Language Processing Market, creating new opportunities for businesses and consumers alike.

Growth of Voice-Activated Technologies

The Natural Language Processing Market is witnessing significant growth due to the proliferation of voice-activated technologies. With the increasing adoption of smart speakers and virtual assistants, consumers are becoming more accustomed to interacting with devices through natural language. This shift is reflected in market data, which indicates that the voice recognition segment is expected to grow at a compound annual growth rate of over 20% in the coming years. Companies are investing heavily in NLP capabilities to enhance user experiences and provide more intuitive interfaces. As voice-activated technologies become more integrated into daily life, the demand for sophisticated NLP solutions that can understand and process human speech is likely to escalate, further driving the expansion of the Natural Language Processing Market.

Growing Need for Enhanced Customer Experience

The Natural Language Processing Market is driven by the growing need for enhanced customer experience across various sectors. Businesses are increasingly leveraging NLP technologies to analyze customer feedback, automate responses, and personalize interactions. This trend is underscored by Market Research Future indicating that companies utilizing NLP for customer engagement can see a significant increase in customer satisfaction scores. As organizations strive to differentiate themselves in competitive markets, the implementation of NLP solutions becomes a strategic imperative. The ability to understand and respond to customer inquiries in real-time not only improves service quality but also fosters customer loyalty, thereby propelling the growth of the Natural Language Processing Market.

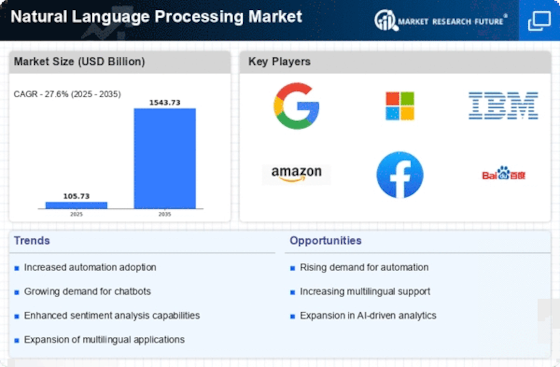

Emergence of Advanced Machine Learning Techniques

The Natural Language Processing Market is being significantly influenced by the emergence of advanced machine learning techniques. Innovations such as deep learning and neural networks are enabling more accurate and efficient language processing capabilities. These advancements allow for better understanding of context, sentiment, and intent in human language, which is crucial for applications ranging from chatbots to sentiment analysis. Market projections suggest that the machine learning segment within NLP is poised to grow substantially, potentially reaching a valuation of several billion dollars by the end of the decade. As organizations seek to harness the power of data, the integration of these advanced techniques into NLP solutions is likely to enhance their effectiveness, thereby propelling the Natural Language Processing Market forward.

Rising Demand for Automation in Business Processes

The Natural Language Processing Market is experiencing a notable surge in demand for automation across various business processes. Organizations are increasingly recognizing the potential of NLP technologies to streamline operations, enhance customer interactions, and improve decision-making. According to recent estimates, the automation of customer service through NLP solutions could lead to a reduction in operational costs by up to 30%. This trend is driven by the need for efficiency and the desire to leverage data-driven insights. As businesses seek to optimize their workflows, the integration of NLP tools becomes essential, thereby propelling the growth of the Natural Language Processing Market. Furthermore, the ability of NLP to analyze vast amounts of unstructured data positions it as a critical component in the digital transformation strategies of enterprises.