Market Trends

Key Emerging Trends in the Integrated Cardiology Devices Market

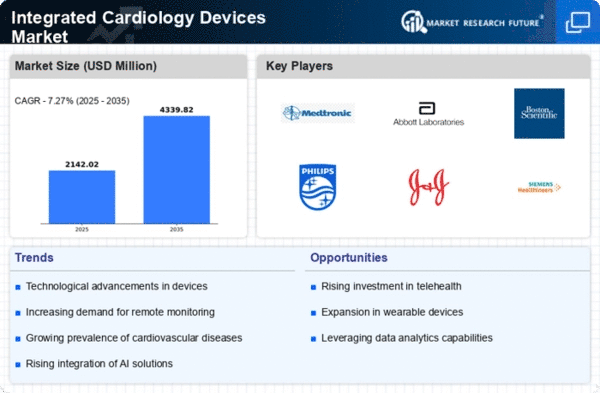

The integrated cardiology devices market has witnessed significant trends and transformations in recent years, reflecting advancements in medical technology and evolving patient needs. One prominent trend is the increasing demand for minimally invasive procedures, which has fueled the adoption of integrated cardiology devices globally. These devices offer healthcare professionals the ability to perform intricate cardiovascular procedures with greater precision and reduced risk to patients.

Moreover, there's a noticeable shift towards the integration of various cardiac diagnostic and therapeutic functionalities into single platforms. This integration streamlines workflow processes in healthcare settings, enhancing efficiency and reducing the overall procedural time. For instance, integrated catheterization laboratories combine imaging technologies, hemodynamic monitoring, and therapeutic devices into a cohesive system, allowing for seamless cardiac interventions.

The market has also seen a surge in the development of wearable and remote monitoring technologies for cardiovascular health management. These innovations enable continuous tracking of vital signs, such as heart rate, blood pressure, and ECG readings, empowering patients to actively participate in their cardiac care and allowing healthcare providers to monitor patients remotely, thereby facilitating early detection of cardiac abnormalities and prompt intervention.

Furthermore, there's a growing emphasis on the incorporation of artificial intelligence (AI) and machine learning algorithms into integrated cardiology devices. These technologies enable the analysis of complex cardiac data sets, facilitating more accurate diagnosis, personalized treatment planning, and predictive analytics for cardiovascular diseases. AI-powered image processing algorithms enhance the interpretation of cardiac imaging modalities, such as echocardiography and angiography, enabling clinicians to identify subtle abnormalities and make informed treatment decisions.

In addition to technological advancements, market trends also reflect changing demographics and healthcare economics. With an aging population and rising prevalence of cardiovascular diseases globally, there's an increased demand for innovative cardiology devices that improve patient outcomes while optimizing healthcare resource utilization. Manufacturers are responding to these demands by investing in research and development initiatives to create next-generation integrated cardiology solutions that address unmet clinical needs and enhance the quality of patient care.

Moreover, the integration of telemedicine and telecardiology platforms into integrated cardiology devices has become more prevalent, especially in remote or underserved areas where access to specialized cardiac care is limited. These platforms facilitate real-time consultation between healthcare providers and patients, enabling timely diagnosis, treatment, and follow-up care for individuals with cardiovascular conditions.

The market landscape is also shaped by regulatory policies and reimbursement frameworks governing the adoption and utilization of integrated cardiology devices. Manufacturers must navigate complex regulatory pathways and demonstrate the safety, efficacy, and cost-effectiveness of their products to gain regulatory approval and secure reimbursement from healthcare payers. Compliance with regulatory standards and alignment with evolving reimbursement policies are crucial considerations for market players seeking to commercialize integrated cardiology devices.

Looking ahead, the integrated cardiology devices market is poised for continued growth and innovation, driven by ongoing technological advancements, demographic trends, and healthcare reforms. As healthcare systems strive to improve patient outcomes, enhance clinical efficiency, and contain costs, integrated cardiology devices will play an increasingly pivotal role in cardiovascular care delivery. By harnessing the power of integration, connectivity, and advanced analytics, these devices have the potential to revolutionize the diagnosis, treatment, and management of cardiovascular diseases, ultimately improving the lives of patients worldwide.

Leave a Comment