Integrated Cardiology Devices Size

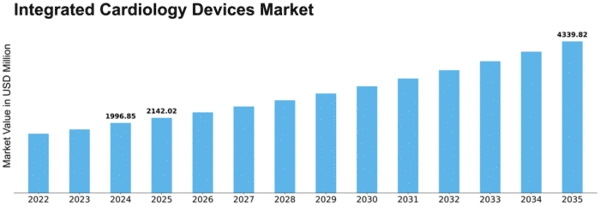

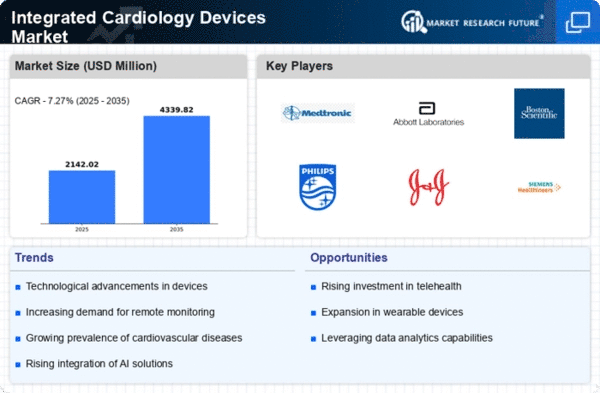

Integrated Cardiology Devices Market Growth Projections and Opportunities

The Integrated Cardiology Devices Market is influenced by various market factors that shape its growth, dynamics, and competitive landscape. These factors encompass a wide range of elements including technological advancements, regulatory policies, economic conditions, and demographic trends.

Technological innovation stands as a primary driver in the Integrated Cardiology Devices Market. As research and development efforts continue to progress, newer and more advanced devices emerge, offering enhanced functionalities and improved patient outcomes. Innovations such as minimally invasive procedures, wireless monitoring systems, and the integration of artificial intelligence are revolutionizing the field, driving demand for integrated cardiology devices.

Regulatory policies play a crucial role in shaping the Integrated Cardiology Devices Market landscape. Stringent regulations and approval processes imposed by regulatory bodies such as the FDA (Food and Drug Administration) in the United States and the EMA (European Medicines Agency) in Europe govern the manufacturing, marketing, and distribution of cardiology devices. Compliance with these regulations is essential for market players to ensure product safety and efficacy, influencing market dynamics and competitive positioning.

Economic conditions also significantly impact the Integrated Cardiology Devices Market. Factors such as healthcare expenditure, reimbursement policies, and overall economic growth influence the adoption rate of integrated cardiology devices. Economic downturns may lead to budget constraints for healthcare facilities, affecting their purchasing decisions and slowing market growth. Conversely, economic prosperity and increased healthcare spending can drive investment in advanced cardiology technologies, stimulating market expansion.

Demographic trends, including aging populations and the rising prevalence of cardiovascular diseases, shape the demand for integrated cardiology devices. As the global population ages, the incidence of cardiovascular conditions such as coronary artery disease, arrhythmias, and heart failure is on the rise. This demographic shift fuels the demand for innovative cardiology devices capable of effectively diagnosing, monitoring, and treating cardiovascular disorders, driving market growth.

Market competition and industry consolidation are additional factors influencing the Integrated Cardiology Devices Market. With a growing number of players entering the market, competition intensifies, prompting companies to differentiate their products through innovation, pricing strategies, and market positioning. Mergers, acquisitions, and strategic partnerships also reshape the competitive landscape, enabling companies to expand their product portfolios, enter new markets, and gain a competitive edge.

Furthermore, evolving healthcare trends, such as the shift towards value-based care and patient-centered approaches, drive the integration of cardiology devices into comprehensive healthcare delivery systems. Integrated solutions that enable seamless data exchange, interoperability, and care coordination are increasingly favored by healthcare providers seeking to improve patient outcomes and reduce healthcare costs.

Geographical factors also influence the Integrated Cardiology Devices Market, with regional variations in healthcare infrastructure, reimbursement policies, and disease prevalence rates impacting market dynamics. Emerging markets in Asia-Pacific, Latin America, and the Middle East offer significant growth opportunities due to increasing healthcare spending, improving access to healthcare services, and rising awareness of cardiovascular health.

Leave a Comment