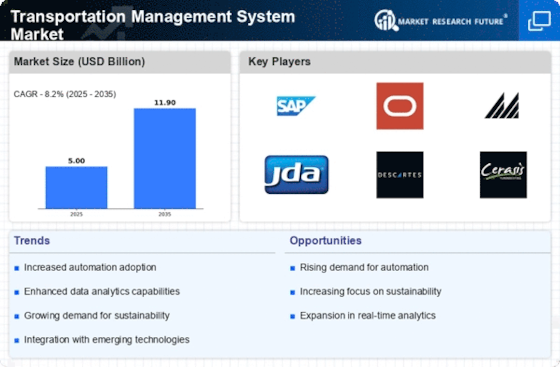

Leading market players are largely investing in research and development to expand their product lines, which will help the transportation management system market, grow even more. The launch of new products, larger-scale mergers and acquisitions, contractual agreements, and collaboration with other organizations are significant market developments in which market participants engage to increase their global presence. The transportation management system industry must provide affordable products to grow and thrive in a more competitive and challenging market environment.

One of the primary business strategies manufacturers use in the global transportation management system industry to increase market sector and benefit customers is local manufacturing to lower operational costs. In recent years, the transportation management system industry has stipulated some of the most important medicinal benefits. Major players in the transportation management system market, including MercuryGate (US), SAP SE (Germany), Alpega Group (Austria), Oracle Corporation (US), and others, are investing in research and development operations to improve market demand.

MercuryGate International is a transportation management system developer that aims to harness the speed of automation and the power of data. The company provides comprehensive logistics solutions that address all customer segments, including shippers, third-party logistics providers (3PLs), freight forwarders, freight brokers, and carriers, lowering shipping and inventory costs, improving order-to-delivery cycle times, and automating the movement of goods across the supply chain.

In February MercuryGate International, Inc. improved its TMS solution by including smart transportation technologies like embedded analytics, artificial intelligence, and machine learning.

This product is ready to help clients by delivering real-time insights about global and local supply chain needs.

Blue Yonder is an artificial intelligence-driven supply chain management service provider dedicated to enabling every person and organization to reach their full potential. Inventory management, order fulfillment services, and workforce management are among the company's services for retailers, manufacturers, and logistics providers, assisting companies in optimizing delivery to customers and seamlessly predicting, pivoting, and serving customer demand.

In March Blue Yonder and Snowflake collaborated to improve access to diverse data for supply chain management.

An end-to-end supply chain solution, the Blue Yonder Luminate Platform, powered by Snowflake, enables retailers, manufacturers, and third-party logistics providers (3PLs) to more accurately predict, prevent, and address disruptions across their businesses which help lower risks and deal with the industry's growing supply chain problems.