The Project Management Software Market is currently experiencing a dynamic evolution, driven by the increasing complexity of projects across various industries. Organizations are recognizing the necessity for robust tools that facilitate collaboration, enhance productivity, and streamline workflows. As remote work becomes more prevalent, the demand for cloud-based solutions is surging, allowing teams to access project data from anywhere. This shift not only improves flexibility but also fosters real-time communication among team members, which is crucial for project success. Furthermore, the integration of artificial intelligence and machine learning into project management tools is emerging as a transformative trend. These technologies offer predictive analytics, enabling organizations to anticipate challenges and make informed decisions, thereby optimizing resource allocation and project timelines. This project management software report provides detailed insights into market size, trends, deployment types, and regional growth forecasts up to 2035. The project management industry is witnessing rapid evolution, driven by digital transformation and the rising complexity of projects across various sectors.

Current project management industry trends indicate a shift towards cloud-based solutions, AI integration, and user-centric design for enhanced collaboration. The project management software market share is led by cloud-based solutions, with key players like Microsoft, Asana, and Trello dominating the landscape. Extensive research on project management software highlights emerging trends, technological adoption, and regional growth potential. The management software industry continues to evolve, with project management solutions playing a pivotal role in digital workflows and enterprise operations.

In addition to technological advancements, there is a growing emphasis on user experience and customization within the Project Management Software Market. Companies are seeking solutions that can be tailored to their specific needs, allowing for greater adaptability in diverse project environments. This trend indicates a shift towards more user-centric designs, where ease of use and functionality are paramount. As the market continues to evolve, it appears that the focus will remain on enhancing collaboration, improving efficiency, and leveraging innovative technologies to meet the demands of modern project management. The management software market encompasses various solutions, including project management software, collaboration tools, and resource planning systems.

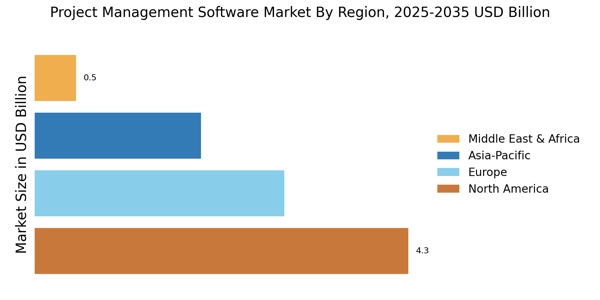

The global project management market is poised for steady growth as enterprises adopt advanced software solutions for task management, resource allocation, and collaboration. The online project management software market is expanding rapidly due to the increasing adoption of cloud-based tools for remote collaboration. The project management software industry is driven by trends like AI integration, cloud adoption, and growing demand for real-time collaboration tools. The worldwide market share indicates North America leads with 45%, followed by Europe and Asia-Pacific, highlighting global adoption trends.

Cloud-Based Solutions

The shift towards cloud-based project management tools is reshaping how teams collaborate and manage tasks. These solutions provide flexibility, enabling users to access information from various locations, which is particularly beneficial for remote teams.

Integration of AI and Machine Learning

The incorporation of artificial intelligence and machine learning into project management software is gaining traction. These technologies facilitate predictive analytics, helping organizations to foresee potential issues and optimize project execution.

User-Centric Design

There is a noticeable trend towards user-centric design in project management tools. Companies are increasingly prioritizing customization and ease of use, ensuring that software solutions can be tailored to meet specific organizational needs.