Sustainability Initiatives

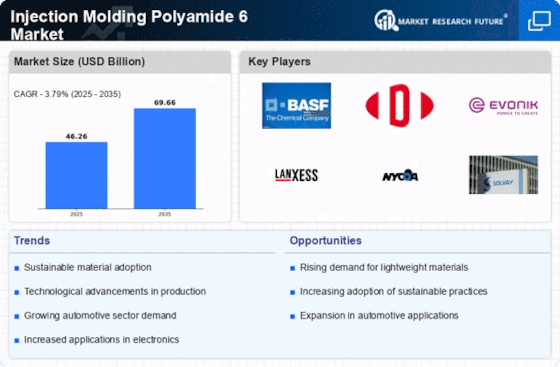

The Injection Molding Polyamide 6 Market is increasingly influenced by sustainability initiatives. Manufacturers are focusing on eco-friendly practices, which include the use of recycled materials and energy-efficient production processes. This shift is driven by consumer demand for sustainable products, as well as regulatory pressures aimed at reducing environmental impact. The market for polyamide 6, known for its recyclability, is expected to grow as companies adopt greener practices. In 2025, the emphasis on sustainability is projected to enhance the market's appeal, potentially leading to a compound annual growth rate of around 5% over the next few years. This trend not only aligns with corporate social responsibility goals but also meets the evolving preferences of environmentally conscious consumers.

Technological Advancements

Technological advancements play a pivotal role in shaping the Injection Molding Polyamide 6 Market. Innovations in processing techniques, such as improved injection molding machinery and automation, are enhancing production efficiency and product quality. These advancements allow for more complex designs and reduced cycle times, which are crucial for meeting the demands of various sectors, including automotive and consumer goods. The integration of Industry 4.0 technologies, such as IoT and AI, is also expected to revolutionize manufacturing processes. As of 2025, the market is witnessing a surge in the adoption of these technologies, which could lead to a significant increase in productivity and a reduction in operational costs, thereby driving market growth.

Rising Consumer Electronics Market

The rising consumer electronics market significantly impacts the Injection Molding Polyamide 6 Market. As electronic devices become more compact and lightweight, the demand for high-performance materials like polyamide 6 is on the rise. This material is favored for its excellent thermal stability and electrical insulation properties, making it ideal for components in smartphones, laptops, and other electronic devices. In 2025, the consumer electronics sector is expected to continue its upward trend, potentially increasing the demand for polyamide 6 by around 7% annually. This growth is indicative of the material's versatility and its ability to meet the stringent requirements of modern electronics, thereby bolstering the overall market.

Growing Demand in Automotive Sector

The automotive sector is a major driver for the Injection Molding Polyamide 6 Market. As vehicles become lighter and more fuel-efficient, manufacturers are increasingly turning to polyamide 6 for its strength-to-weight ratio and durability. The material is utilized in various automotive components, including under-the-hood parts, interior fittings, and exterior panels. In 2025, the demand for polyamide 6 in automotive applications is projected to rise, driven by the industry's shift towards electric vehicles and advanced safety features. This trend is likely to contribute to a robust growth trajectory for the market, with estimates suggesting an increase in market share of approximately 10% in the automotive segment alone over the next few years.

Expansion of Industrial Applications

The expansion of industrial applications is a notable driver for the Injection Molding Polyamide 6 Market. Industries such as packaging, construction, and textiles are increasingly utilizing polyamide 6 due to its mechanical strength and resistance to chemicals. The material's adaptability makes it suitable for a wide range of applications, from industrial machinery components to consumer goods packaging. As of 2025, the industrial sector is projected to experience a growth rate of approximately 6% in the use of polyamide 6, driven by the need for durable and efficient materials. This trend reflects the material's growing acceptance across various industries, further solidifying its position in the market.