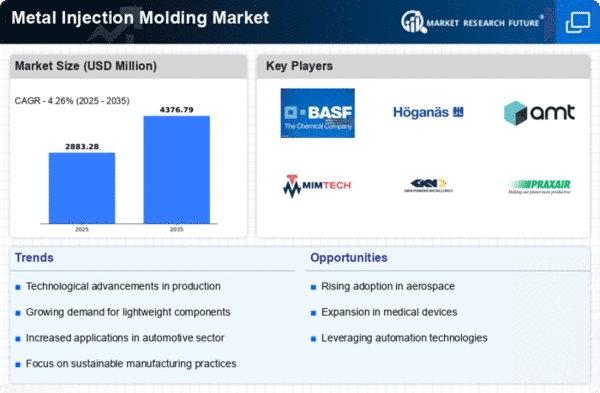

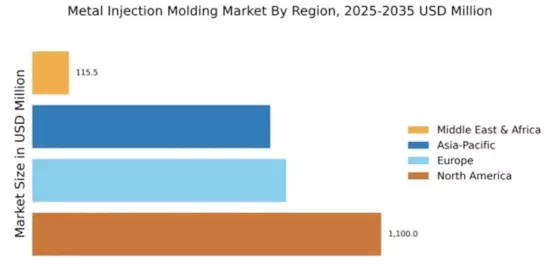

North America : Market Leader in Molding

North America metal injection molding market is poised to maintain its leadership in the, holding a significant share of 1100.0. The region's growth is driven by advanced manufacturing technologies, increasing demand for precision components, and supportive regulatory frameworks. The automotive and aerospace sectors are particularly influential in North America metal injection molding market, pushing for innovative solutions that enhance efficiency and reduce costs.

The competitive landscape is robust in North America metal injection molding market, with key players like PMT, MIMtech, and GKN Powder Metallurgy leading the charge. The U.S. stands out as a major contributor in North America metal injection molding market, supported by a strong industrial base and investment in R&D. The presence of established companies ensures a dynamic North America metal injection molding market, fostering innovation and collaboration across sectors.

Europe : Innovation and Sustainability Focus

Metal Injection Molding market is projected at 800.0, driven by a strong emphasis on sustainability and innovation. Regulatory initiatives aimed at reducing carbon footprints and enhancing product lifecycle management are pivotal in Europe Metal Injection Molding market. The region's commitment to green technologies and efficient manufacturing processes is reshaping demand, particularly in the automotive and medical sectors in Europe Metal Injection Molding market.

Leading countries like Germany, Sweden, and the UK are at the forefront, with companies such as BASF and Hoganas making significant contributions in Europe Metal Injection Molding market. The competitive landscape is characterized by a mix of established firms and innovative startups, all striving to meet stringent regulatory standards and consumer expectations. "The Europe Metal Injection Molding market is increasingly focused on sustainable manufacturing practices," European Commission report.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region, with a market size of 750.0 million, is witnessing rapid growth in Metal Injection Molding, driven by increasing industrialization and urbanization. Countries like China and India are at the forefront, with rising demand for consumer electronics and automotive components. The region's growth is further supported by favorable government policies and investments in manufacturing infrastructure, making it a key player in the global market. China is the leading country in this sector, with numerous local and international players vying for market share. The competitive landscape is evolving, with companies like GKN Powder Metallurgy and Praxair Technology, Inc. expanding their operations. The Asia-Pacific market is characterized by a mix of established firms and emerging players, creating a vibrant ecosystem for innovation and growth.

South America: Developing Manufacturing Landscape

The South America metal injection molding market is gradually gaining traction, supported by increasing industrialization, automotive manufacturing growth, and rising demand for precision components in Brazil and Argentina.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa (MEA) region, with a market size of 115.47 million, presents untapped opportunities in the Metal Injection Molding sector. The growth is driven by increasing industrial activities and a focus on local manufacturing. Countries like South Africa and the UAE are investing in advanced manufacturing technologies, aiming to reduce reliance on imports and enhance local production capabilities. The competitive landscape is still developing, with a mix of local and international players entering the market. The presence of key players is gradually increasing, fostering innovation and collaboration. As the region continues to invest in infrastructure and technology, the Metal Injection Molding market is expected to grow, driven by both domestic demand and export opportunities.