Top Industry Leaders in the Influenza Vaccination Market

Latest Influenza Vaccines Companies Update

Latest Influenza Vaccines Companies Update

-

October 2023: Mylab and Serum Institute of India (SII), both based in the city, have introduced Nasovac S4, the first needle-free nasal influenza vaccine in India. Vaccination will be accessible throughout India via a network of clinics and healthcare providers. In accordance with WHO guidelines, Nasovac S4 is a live quadrivalent influenza vaccine comprising four genotypes of the influenza vaccine virus. The vaccine contains two influenza Type B virus strains and two influenza Type A virus strains (A/H1N1 and A/H3N2, according to a statement issued by Mylab Discovery Solutions). Nasovac S4 is recommended for patients older than 2 years old as it effectively immunizes against influenza viruses caused by the specified strains. The action of this nasal spray influenza vaccine is initiated in the nasal passages, where it induces the production of antibodies against influenza infection by the immune system. Nasovac S4 is prescribed for animals older than two years with a single intranasal dosage.

-

November 2023: Integral Molecular, a market leader in vaccine evaluation reagents, introduces TiterSafe™ influenza virus-like particles in November 2023. These particles serve as a substitute for commercially available viruses and are utilized in critical experiments aimed at testing influenza vaccines. TiterSafe is a convenient and risk-free alternative to live virus that is suitable for high-throughput assays, reduces biosafety risks for laboratory personnel, and is immediately usable. TiterSafe particles emulate the structural characteristics of living viruses by incorporating a protein nucleus and surface influenza proteins hemagglutinin (HA) and neuraminidase (NA). They are devoid of DNA or RNA components, which are critical for virus replication.

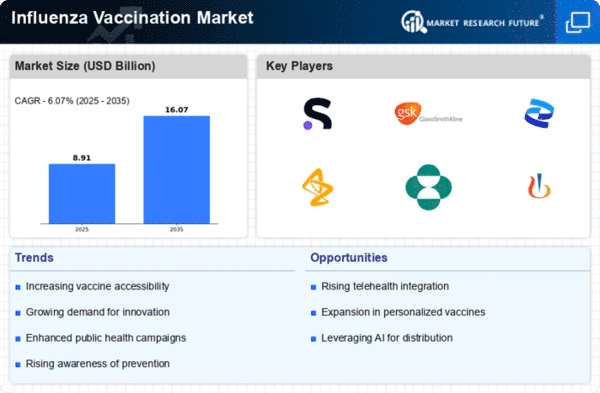

List of Influenza Vaccines Key companies in the market

- GlaxoSmithKline PLC (UK)

- Abbott Laboratories (US)

- Seqirus (UK)

- Mylan NV (US)

- AstraZeneca (UK)

- Hualan Biological Engineering Inc. (China)