Growth in the Construction Sector

The Industrial Wood Adhesives Market is closely linked to the construction sector, which continues to expand due to urbanization and infrastructure development. As new residential and commercial buildings are constructed, the demand for wood-based products, such as furniture and cabinetry, increases. This growth in construction activities is expected to drive the demand for industrial wood adhesives, as they are essential for bonding wood components in various applications. Recent data indicates that the construction industry is projected to grow at a CAGR of approximately 4% over the next five years, further bolstering the market for wood adhesives. This correlation suggests that as construction activities rise, so too will the need for effective and reliable adhesive solutions.

Expansion of the Furniture Industry

The Industrial Wood Adhesives Market is significantly influenced by the expansion of the furniture industry, which is experiencing a renaissance driven by changing consumer preferences and lifestyle choices. As consumers increasingly seek customized and high-quality furniture, manufacturers are turning to advanced adhesive solutions to meet these demands. The furniture sector is projected to grow at a CAGR of approximately 5% in the coming years, which will likely result in heightened demand for industrial wood adhesives. This growth presents an opportunity for adhesive producers to innovate and offer products that enhance the aesthetic and functional qualities of furniture, thereby solidifying their position in a competitive market.

Rising Demand for Eco-Friendly Products

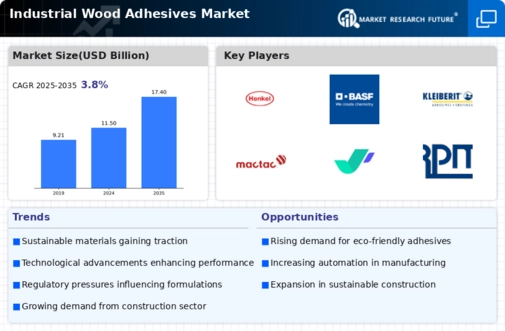

The Industrial Wood Adhesives Market is experiencing a notable shift towards eco-friendly products, driven by increasing consumer awareness regarding environmental sustainability. Manufacturers are responding to this trend by developing adhesives that are low in volatile organic compounds (VOCs) and derived from renewable resources. This shift is not merely a response to consumer preferences; it is also influenced by regulatory frameworks that promote sustainable practices. As a result, the market for eco-friendly wood adhesives is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 5% in the coming years. This trend indicates a robust opportunity for companies that prioritize sustainability in their product offerings.

Increasing Use of Engineered Wood Products

The Industrial Wood Adhesives Market is witnessing a surge in the use of engineered wood products, such as laminated veneer lumber and oriented strand board. These products are gaining popularity due to their superior strength, stability, and versatility compared to traditional solid wood. The rise in engineered wood applications is driving the demand for specialized adhesives that can effectively bond these materials. Market analysis suggests that the engineered wood product segment is expected to grow at a CAGR of around 6% over the next few years, indicating a robust opportunity for adhesive manufacturers to develop tailored solutions that meet the specific requirements of these products. This trend highlights the evolving landscape of the wood industry and the corresponding need for innovative adhesive technologies.

Technological Innovations in Adhesive Formulations

Technological advancements are playing a pivotal role in shaping the Industrial Wood Adhesives Market. Innovations in adhesive formulations, such as the development of water-based and bio-based adhesives, are enhancing performance characteristics while reducing environmental impact. These advancements not only improve the bonding strength and durability of wood products but also cater to the growing demand for sustainable solutions. Furthermore, the integration of smart technologies in adhesive applications is emerging, allowing for real-time monitoring of adhesive performance. This trend indicates a potential shift in how adhesives are utilized in manufacturing processes, suggesting that companies that invest in research and development may gain a competitive edge in the market.

Leave a Comment