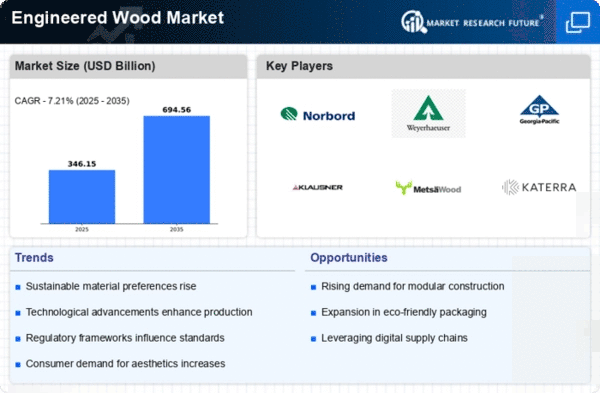

Market Growth Projections

The Global Engineered Wood Market Industry is projected to experience substantial growth over the coming years. With a market size anticipated to reach 322.9 USD Billion in 2024 and further expand to 694.5 USD Billion by 2035, the industry is on a robust upward trajectory. This growth is underpinned by a compound annual growth rate of 7.21% from 2025 to 2035, indicating strong demand across various sectors. The increasing adoption of engineered wood in residential, commercial, and industrial applications reflects a broader trend towards sustainable construction practices and innovative building solutions.

Sustainable Building Practices

The increasing emphasis on sustainable building practices drives the Global Engineered Wood Market Industry. Engineered wood products, such as cross-laminated timber and laminated veneer lumber, are recognized for their lower carbon footprint compared to traditional materials like concrete and steel. This shift towards sustainability is evident as governments worldwide implement stricter building codes and regulations promoting eco-friendly materials. For instance, many countries are setting targets for carbon neutrality, which further propels the demand for engineered wood. As a result, the Global Engineered Wood Market is projected to reach 322.9 USD Billion in 2024, reflecting the growing preference for sustainable construction solutions.

Regulatory Support for Wood-Based Products

Regulatory support for wood-based products plays a crucial role in shaping the Global Engineered Wood Industry. Governments are increasingly recognizing the benefits of engineered wood in promoting sustainable forestry practices and reducing greenhouse gas emissions. Policies that incentivize the use of engineered wood in construction projects are becoming more prevalent, encouraging builders to adopt these materials. This regulatory backing not only fosters market growth but also aligns with global sustainability goals. As such, the Global Engineered Wood Market is poised for expansion, driven by favorable regulations that support the adoption of eco-friendly building materials.

Urbanization and Infrastructure Development

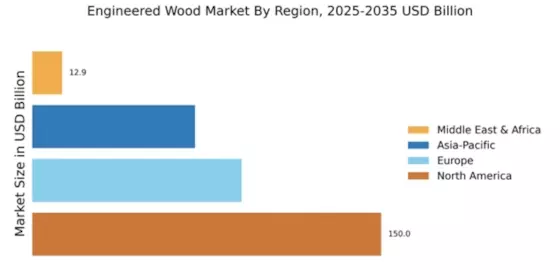

Rapid urbanization and infrastructure development are pivotal factors influencing the Global Engineered Wood Market Industry. As populations in urban areas continue to swell, the demand for housing and commercial spaces rises correspondingly. Engineered wood offers a lightweight yet robust alternative to traditional building materials, facilitating faster construction timelines and reduced labor costs. Countries in Asia-Pacific, particularly China and India, are experiencing significant growth in urban infrastructure projects. This trend is expected to sustain the market's expansion, with projections indicating a market size of 694.5 USD Billion by 2035, driven by the ongoing need for innovative building solutions.

Growing Demand for Prefabricated Construction

The growing demand for prefabricated construction methods is a significant driver of the Global Engineered Wood Market Industry. Prefabrication allows for components to be manufactured off-site and assembled on-site, which can lead to reduced construction time and costs. Engineered wood products are particularly well-suited for prefabrication due to their versatility and ease of handling. This trend is becoming increasingly popular in residential and commercial projects, as builders seek to optimize efficiency and minimize waste. The rise in prefabricated construction is expected to bolster the market, aligning with the overall growth trajectory of engineered wood products.

Technological Advancements in Wood Processing

Technological advancements in wood processing significantly enhance the efficiency and quality of engineered wood products, thereby impacting the Global Wood Market size. Innovations such as advanced adhesive technologies and precision manufacturing techniques allow for the production of stronger and more durable engineered wood materials. These improvements not only increase the performance of engineered wood but also expand its applications in various sectors, including residential, commercial, and industrial construction. As these technologies continue to evolve, they are likely to attract more investments and drive market growth, contributing to a projected CAGR of 7.21% from 2025 to 2035.