Increased Consumer Awareness

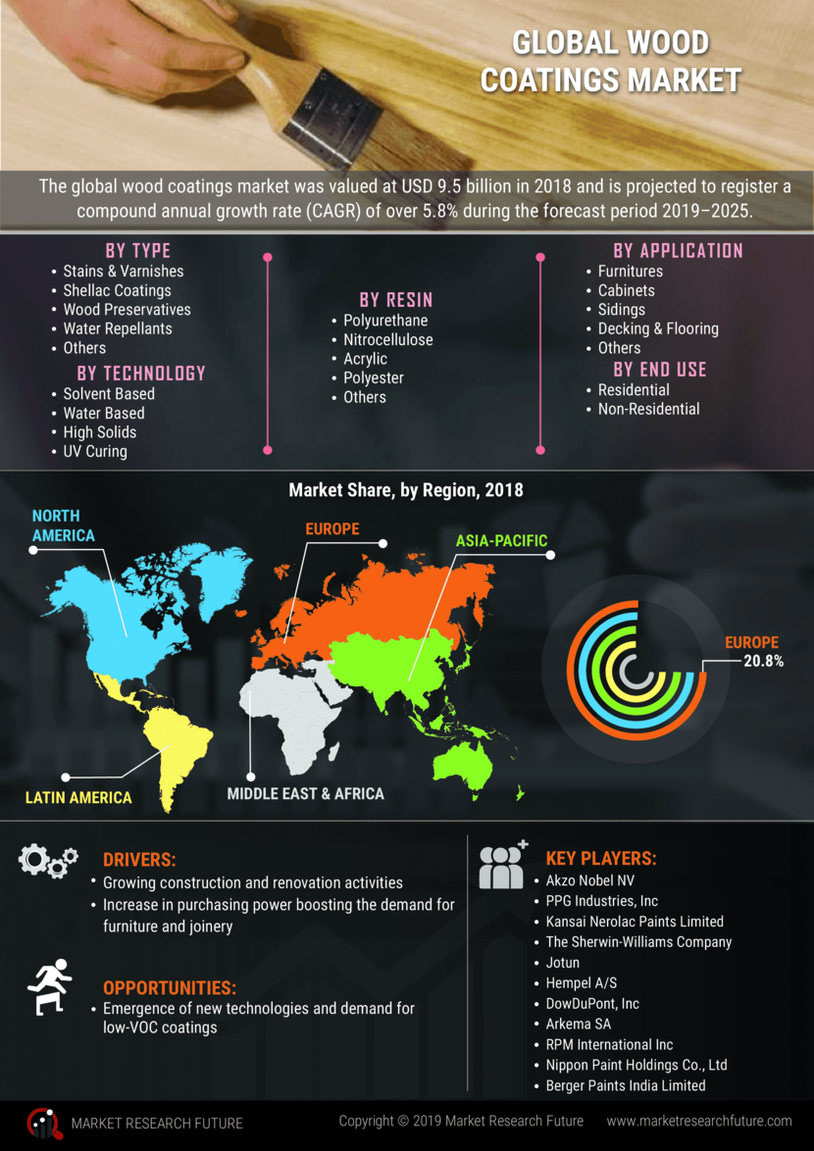

Consumer awareness regarding the benefits of wood coatings is significantly influencing the Wood Coatings Market. As individuals become more informed about the protective qualities and aesthetic enhancements that wood coatings offer, the demand for these products is likely to rise. In recent years, there has been a notable shift towards premium wood coatings that provide superior durability and finish. This trend is reflected in market data, which indicates that the premium segment of the wood coatings market is expected to grow at a compound annual growth rate of around 6% through 2025. Consumers are increasingly seeking products that not only enhance the appearance of wood but also offer long-lasting protection against environmental factors. Consequently, manufacturers are responding by developing innovative formulations that cater to this heightened consumer demand, thereby propelling the Wood Coatings Market forward.

Rising Construction Activities

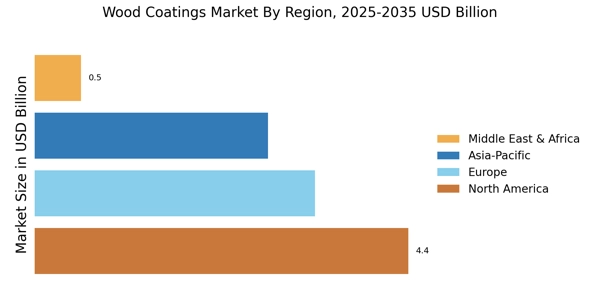

The Wood Coatings Market is experiencing a surge in demand due to increasing construction activities across various sectors. As urbanization continues to expand, the need for residential and commercial buildings rises, leading to a higher requirement for wood coatings. In 2025, the construction sector is projected to grow at a rate of approximately 5.5% annually, which directly influences the wood coatings market. This growth is driven by the need for durable and aesthetically pleasing finishes that wood coatings provide. Furthermore, the trend towards sustainable building practices encourages the use of eco-friendly wood coatings, which are gaining traction among builders and architects. As a result, the Wood Coatings Market is likely to benefit from this construction boom, with manufacturers focusing on innovative products that meet the evolving needs of the construction sector.

Technological Innovations in Coatings

Technological advancements are playing a pivotal role in shaping the Wood Coatings Market. Innovations in coating formulations, such as the development of water-based and low-VOC (volatile organic compounds) coatings, are gaining popularity due to their environmental benefits and ease of application. These advancements not only enhance the performance of wood coatings but also align with the growing demand for sustainable products. Market analysis suggests that the introduction of smart coatings, which can change color or provide additional functionalities, may further revolutionize the industry. As manufacturers invest in research and development to create cutting-edge products, the Wood Coatings Market is likely to witness a transformation that meets both consumer preferences and regulatory standards. This focus on innovation is expected to drive growth and expand the range of available wood coating solutions.

Regulatory Support for Eco-Friendly Products

Regulatory frameworks promoting eco-friendly products are increasingly impacting the Wood Coatings Market. Governments are implementing stricter regulations regarding the use of harmful chemicals in coatings, which is pushing manufacturers to develop safer, environmentally friendly alternatives. This shift is evident in the rising demand for low-VOC and water-based coatings, which are not only compliant with regulations but also appeal to environmentally conscious consumers. Market data indicates that the eco-friendly segment of the wood coatings market is expected to grow at a compound annual growth rate of around 7% through 2025. As regulations continue to evolve, manufacturers are likely to prioritize the development of sustainable products, thereby enhancing their market position within the Wood Coatings Market. This regulatory support is expected to foster innovation and drive growth in the sector.

Growth in Furniture and Interior Design Sectors

The Wood Coatings Market is significantly influenced by the expansion of the furniture and interior design sectors. As consumer preferences shift towards personalized and high-quality furniture, the demand for wood coatings that enhance the visual appeal and durability of these products is increasing. In 2025, the furniture market is anticipated to grow at a rate of approximately 4.5%, which will likely boost the wood coatings segment as manufacturers seek to provide finishes that meet the aesthetic and functional needs of consumers. Additionally, the trend towards open-concept living spaces encourages the use of wood in interior design, further driving the need for effective wood coatings. This synergy between the furniture and interior design industries and the Wood Coatings Market presents opportunities for manufacturers to innovate and cater to evolving consumer tastes.