Increased Focus on Quality Assurance

Quality assurance remains a critical driver in the Industrial Vision Market, as companies prioritize the delivery of defect-free products. The implementation of vision systems allows for comprehensive inspections at various stages of production, thereby reducing the likelihood of errors and enhancing customer satisfaction. Recent statistics indicate that industries investing in quality assurance technologies, including vision systems, have reported a decrease in product returns by up to 30%. This focus on quality not only improves brand reputation but also contributes to long-term profitability. As competition intensifies, the demand for reliable quality assurance solutions is expected to propel the growth of the industrial vision market.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent across various industries, thereby driving the demand for the Industrial Vision Market. Companies are required to adhere to specific quality and safety regulations, which necessitate the implementation of reliable inspection systems. Vision technology plays a crucial role in ensuring compliance by providing accurate and consistent monitoring of production processes. Data suggests that industries that invest in compliance-related technologies, including vision systems, experience fewer regulatory violations and associated penalties. As regulatory frameworks evolve, the need for advanced vision solutions is expected to grow, further propelling the market forward.

Growing Adoption of Robotics in Manufacturing

The Industrial Vision Market is witnessing a growing adoption of robotics, which is closely linked to advancements in vision technology. Robotic systems equipped with vision capabilities are increasingly utilized for tasks such as assembly, packaging, and inspection. This integration enhances the precision and speed of operations, making it a preferred choice for manufacturers aiming to optimize their processes. Market analysis indicates that the robotics segment is likely to expand at a rate of approximately 12% over the next few years, driven by the need for greater efficiency and flexibility in production. The synergy between robotics and vision systems is expected to redefine manufacturing paradigms, leading to smarter and more agile production environments.

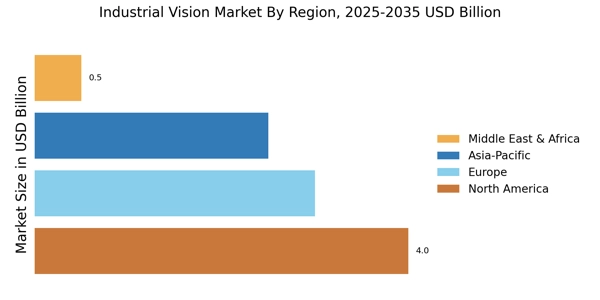

Rising Demand for Automation in Manufacturing

The Industrial Vision Market is significantly influenced by the rising demand for automation in manufacturing processes. As industries strive for higher efficiency and reduced labor costs, the integration of automated vision systems becomes essential. These systems facilitate real-time monitoring and quality control, ensuring that production lines operate smoothly and meet stringent quality requirements. Market data suggests that the automation segment is expected to account for a substantial share of the overall market, with projections indicating a growth rate of around 10% annually. This trend reflects a broader shift towards smart manufacturing, where industrial vision systems play a pivotal role in enhancing productivity and minimizing human error.

Technological Advancements in Imaging Systems

The Industrial Vision Market is experiencing a surge in technological advancements, particularly in imaging systems. Innovations such as high-resolution cameras, 3D imaging, and hyperspectral imaging are enhancing the capabilities of industrial vision systems. These advancements enable more precise inspections and better defect detection, which are crucial for maintaining quality standards in manufacturing. According to recent data, the imaging technology segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is indicative of the increasing reliance on sophisticated imaging solutions to improve operational efficiency and reduce costs in various sectors, including automotive, electronics, and pharmaceuticals.