Growing Need for Data Analytics

The industrial vision market in North America is increasingly driven by the growing need for data analytics in manufacturing processes. Vision systems are not only used for inspection but also for gathering valuable data that can inform decision-making. The ability to analyze visual data allows companies to identify trends, optimize processes, and enhance overall efficiency. As industries become more data-driven, the demand for vision systems equipped with advanced analytics capabilities is likely to rise. This trend is reflected in the projected growth of the data analytics market, which is expected to reach $274 billion by 2022. Consequently, the industrial vision market is expected to benefit from this shift towards data-centric operations, as organizations seek to harness the power of analytics to improve their manufacturing processes.

Rising Demand for Quality Control

Quality control remains a pivotal driver in the industrial vision market in North America. As manufacturers strive to enhance product quality and reduce defects, the reliance on automated vision systems has intensified. Industries such as automotive, electronics, and food processing are increasingly implementing vision systems to ensure compliance with stringent quality standards. The market for quality control solutions is expected to reach approximately $1.5 billion by 2026, reflecting a growing emphasis on precision and reliability. This trend indicates that companies are willing to invest in advanced vision technologies to maintain competitive advantage. Consequently, the industrial vision market is likely to expand as organizations prioritize quality assurance through automation and advanced imaging techniques.

Increased Investment in Automation

The industrial vision market in North America is significantly influenced by the increased investment in automation across various sectors. Companies are recognizing the potential of automated vision systems to enhance operational efficiency and reduce labor costs. As industries adopt smart manufacturing practices, the integration of vision systems into production lines is becoming commonplace. Reports suggest that the automation market is projected to grow to $200 billion by 2027, with a substantial portion allocated to vision technologies. This trend indicates a shift towards more automated processes, where vision systems play a critical role in monitoring and controlling production quality. As a result, the industrial vision market is poised for growth as businesses seek to leverage automation for improved productivity.

Technological Advancements in Imaging Systems

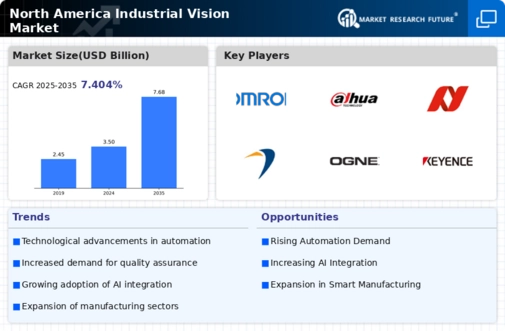

The industrial vision market in North America is experiencing a surge due to rapid technological advancements in imaging systems. Innovations such as high-resolution cameras, 3D imaging, and hyperspectral imaging are enhancing the capabilities of vision systems. These advancements enable industries to achieve higher accuracy and efficiency in quality control processes. For instance, the integration of advanced sensors and imaging algorithms allows for real-time defect detection, which is crucial in manufacturing. The market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, driven by these technological improvements. As industries increasingly adopt these sophisticated imaging solutions, the demand for high-performance vision systems is likely to rise, further propelling the industrial vision market in North America.

Emphasis on Sustainability and Energy Efficiency

Sustainability and energy efficiency are becoming increasingly important in the industrial vision market in North America. As companies strive to reduce their environmental impact, there is a growing demand for vision systems that contribute to sustainable practices. These systems can help optimize resource usage, minimize waste, and enhance energy efficiency in manufacturing processes. The market for energy-efficient technologies is projected to grow significantly, with investments in sustainable solutions expected to reach $1 trillion by 2030. This trend suggests that organizations are prioritizing sustainability in their operations, which in turn drives the adoption of advanced vision systems. As a result, the industrial vision market is likely to expand as companies seek to align their operations with sustainability goals.