Expansion of Manufacturing Sector

The expansion of the manufacturing sector in South America is a key driver for the industrial vision market. As countries in the region enhance their manufacturing capabilities, there is a growing need for automation and advanced inspection systems. This expansion is fueled by government initiatives aimed at boosting local production and attracting foreign investment. The industrial vision market is likely to benefit from this trend, with an estimated increase in market size by $500 million over the next five years. The integration of vision systems into manufacturing processes is becoming essential for maintaining competitiveness and operational efficiency.

Growing Demand for Quality Control

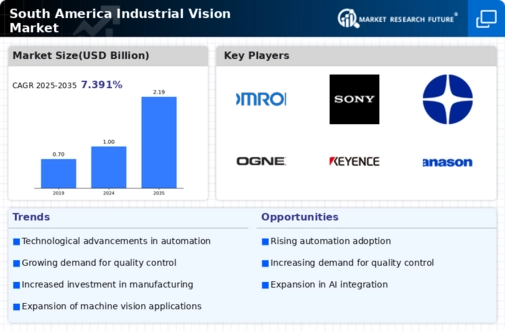

In South America, the industrial vision market is significantly driven by the increasing demand for quality control across various sectors. Industries such as automotive, electronics, and pharmaceuticals are adopting vision systems to ensure product quality and compliance with regulatory standards. The need for consistent quality has led to a rise in the implementation of automated inspection systems, which can detect defects and anomalies more efficiently than manual processes. This trend is expected to contribute to a market growth rate of around 7% annually, reflecting the critical role of quality assurance in the industrial vision market.

Increased Focus on Safety Standards

In South America, the industrial vision market is influenced by an increased focus on safety standards across various industries. Companies are recognizing the importance of adhering to safety regulations, which often necessitate the implementation of automated inspection systems. These systems help in identifying potential hazards and ensuring compliance with safety protocols. As industries strive to enhance workplace safety, the demand for vision systems is expected to rise. This trend may lead to a market growth of approximately 6% annually, underscoring the critical role of safety in the industrial vision market.

Technological Advancements in Imaging

The industrial vision market in South America is experiencing a surge due to rapid technological advancements in imaging technologies. Innovations such as high-resolution cameras and advanced image processing algorithms are enhancing the capabilities of vision systems. These improvements enable more accurate inspections and quality control processes across various industries, including manufacturing and food processing. As a result, companies are increasingly investing in these technologies to improve operational efficiency. The market for imaging systems is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust demand for advanced imaging solutions in the industrial vision market.

Rising Labor Costs and Skills Shortages

The industrial vision market in South America is also driven by rising labor costs and a shortage of skilled labor. As companies face challenges in hiring qualified personnel, there is a growing inclination towards automation and the adoption of vision systems. These systems can perform tasks that would typically require skilled labor, thus mitigating the impact of labor shortages. The trend towards automation is likely to propel the industrial vision market, with projections indicating a potential market growth of 5% annually. This shift reflects a broader movement towards efficiency and cost-effectiveness in industrial operations.