Germany : Strong Growth and Innovation Hub

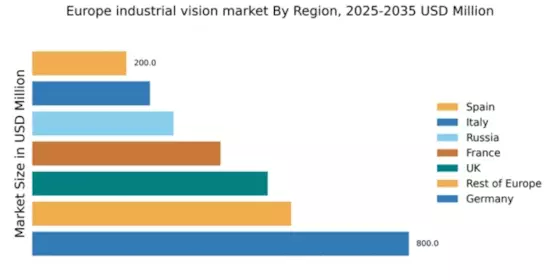

Germany holds a dominant position in the European industrial vision market, accounting for 32% of the total market share with a value of $800.0 million. Key growth drivers include a robust manufacturing sector, increasing automation, and a strong emphasis on Industry 4.0 initiatives. Demand trends show a rising adoption of machine vision systems across various industries, supported by favorable regulatory policies and government initiatives aimed at enhancing technological advancements. The country’s well-developed infrastructure further facilitates industrial growth.

UK : Innovation and Investment on the Rise

The UK industrial vision market is valued at $500.0 million, representing 20% of the European market share. Growth is driven by increasing investments in automation and robotics, particularly in sectors like automotive and pharmaceuticals. Demand for advanced imaging solutions is rising, supported by government initiatives promoting digital transformation. The UK’s strong research and development ecosystem fosters innovation, enhancing the market's appeal.

France : Strong Demand Across Multiple Sectors

France's industrial vision market is valued at $400.0 million, capturing 16% of the European market. Key growth drivers include the automotive, aerospace, and food processing industries, which are increasingly adopting vision systems for quality control and automation. Regulatory support for technological advancements and sustainability initiatives further boost market demand. The country’s diverse industrial base creates a favorable environment for vision technology adoption.

Russia : Investment in Automation and Technology

Russia's industrial vision market is valued at $300.0 million, accounting for 12% of the European market share. Growth is driven by increased investments in automation and modernization of manufacturing processes. Demand trends indicate a rising interest in machine vision systems, particularly in the oil and gas, and manufacturing sectors. Government initiatives aimed at enhancing industrial capabilities support this growth trajectory, although regulatory challenges remain.

Italy : Key Player in Vision Systems

Italy's industrial vision market is valued at $250.0 million, representing 10% of the European market. The growth is primarily driven by the manufacturing sector, particularly in textiles and automotive, where quality control is paramount. Demand for advanced vision systems is increasing, supported by government initiatives promoting innovation and competitiveness. The competitive landscape features local players alongside international firms, enhancing market dynamics.

Spain : Focus on Automation and Efficiency

Spain's industrial vision market is valued at $200.0 million, capturing 8% of the European market. Key growth drivers include the automotive and electronics sectors, where there is a strong push for automation and efficiency. Demand trends show an increasing adoption of vision systems for quality assurance and process optimization. Government initiatives aimed at fostering technological innovation further support market growth, although economic fluctuations pose challenges.

Rest of Europe : Varied Applications Across Regions

The Rest of Europe industrial vision market is valued at $550.0 million, accounting for 22% of the total market share. This sub-region encompasses a variety of markets with unique demands, driven by local industries such as food processing, pharmaceuticals, and electronics. Growth is supported by regional government initiatives promoting automation and technological advancements. The competitive landscape features a mix of local and international players, catering to diverse sector-specific applications.