Environmental Regulations

The Industrial Phosphate Market is increasingly influenced by stringent environmental regulations aimed at reducing the ecological footprint of phosphate production. Governments are implementing policies that promote sustainable practices and limit harmful emissions associated with phosphate mining and processing. For example, regulations concerning water usage and waste management are becoming more prevalent, compelling companies to adopt greener technologies. This shift not only aligns with global sustainability goals but also presents opportunities for innovation within the industry. Companies that proactively adapt to these regulations may gain a competitive edge, potentially reshaping market dynamics in favor of environmentally responsible practices.

Technological Innovations

Technological advancements are playing a pivotal role in shaping the Industrial Phosphate Market. Innovations in extraction and processing techniques are enhancing the efficiency and sustainability of phosphate production. For instance, the development of more effective methods for recovering phosphates from waste materials is gaining traction. This not only reduces environmental impact but also contributes to a circular economy. Additionally, advancements in application technologies, such as controlled-release fertilizers, are likely to optimize phosphate utilization in agriculture. As these technologies continue to evolve, they may significantly influence market dynamics and drive growth in the industrial phosphate sector.

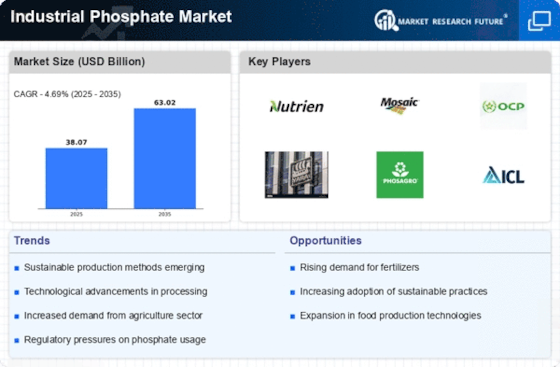

Rising Demand in Agriculture

The Industrial Phosphate Market is experiencing a notable surge in demand, primarily driven by the agricultural sector. Phosphates are essential for plant growth, and as the global population continues to expand, the need for efficient fertilizers becomes increasingly critical. In 2023, the fertilizer segment accounted for approximately 80% of the total phosphate consumption, indicating a strong reliance on phosphates for food production. This trend is likely to persist, as agricultural practices evolve to meet the challenges of food security. Furthermore, the increasing adoption of precision farming techniques may enhance the efficiency of phosphate use, thereby potentially boosting the overall market for industrial phosphates.

Growing Demand for Animal Feed

The Industrial Phosphate Market is witnessing a growing demand for phosphates in the animal feed sector. Phosphates are crucial for livestock nutrition, contributing to bone development and overall health. As meat consumption rises, particularly in developing regions, the need for high-quality animal feed is expected to increase. In 2023, the animal feed segment represented a significant portion of phosphate consumption, and this trend is anticipated to continue. The integration of phosphates in feed formulations not only enhances livestock productivity but also supports the overall growth of the industrial phosphate market, as producers seek to meet the nutritional needs of a burgeoning population.

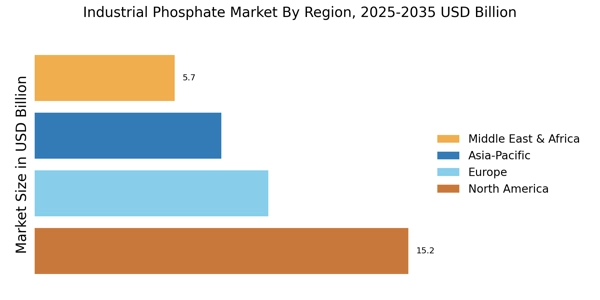

Emerging Markets and Economic Growth

The Industrial Phosphate Market is poised for growth, particularly in emerging markets where economic development is driving increased agricultural and industrial activities. Countries experiencing rapid urbanization and population growth are likely to see a corresponding rise in phosphate demand. For instance, regions with expanding agricultural sectors are investing in fertilizers to boost crop yields. This economic growth is expected to create new opportunities for phosphate producers, as they seek to cater to the evolving needs of these markets. As infrastructure improves and agricultural practices modernize, the industrial phosphate market may witness substantial expansion in these regions.