Rising Demand for Automation

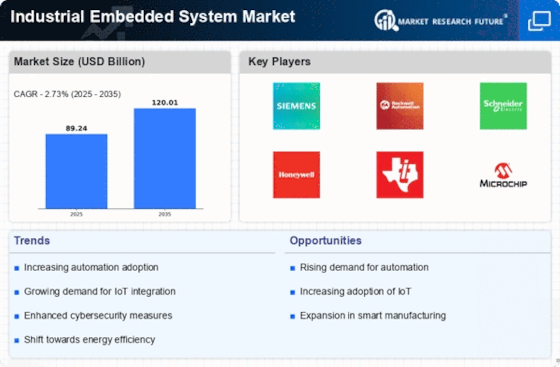

The Industrial Embedded System Market Industry is experiencing a notable surge in demand for automation across various sectors. Industries are increasingly adopting embedded systems to enhance operational efficiency and reduce human error. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This trend is driven by the need for real-time data processing and decision-making capabilities, which embedded systems provide. As companies strive to optimize production processes, the integration of advanced embedded systems becomes essential. This shift not only improves productivity but also contributes to cost savings, making automation a key driver in the Industrial Embedded System Market Industry.

Emphasis on Safety and Compliance

Safety and compliance regulations are becoming increasingly stringent across various industries, driving the demand for reliable embedded systems. The Industrial Embedded System Market Industry is witnessing a heightened focus on developing systems that not only meet regulatory standards but also enhance operational safety. Industries such as automotive and healthcare are particularly affected, as they require embedded systems that ensure safety and reliability. The integration of safety features into embedded systems can lead to a competitive advantage, as companies strive to comply with regulations while maintaining high operational standards. This emphasis on safety is likely to propel the growth of the Industrial Embedded System Market Industry.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into embedded systems is transforming the Industrial Embedded System Market Industry. AI enhances the capabilities of embedded systems by enabling them to learn from data and make intelligent decisions. This advancement is particularly relevant in applications such as predictive analytics, quality control, and process optimization. As industries increasingly adopt AI-driven solutions, the demand for sophisticated embedded systems that can support these technologies is expected to rise. The potential for AI to improve efficiency and reduce operational costs positions it as a key driver in the Industrial Embedded System Market Industry.

Growing Focus on Predictive Maintenance

Predictive maintenance is emerging as a critical driver within the Industrial Embedded System Market Industry. By leveraging embedded systems, industries can monitor equipment health in real-time, allowing for timely interventions before failures occur. This proactive approach reduces downtime and maintenance costs, which is particularly vital in sectors such as manufacturing and energy. Recent studies indicate that predictive maintenance can lead to a reduction in maintenance costs by up to 30%. As organizations increasingly recognize the value of maintaining operational continuity, the demand for embedded systems that facilitate predictive maintenance is likely to rise, further propelling the growth of the Industrial Embedded System Market Industry.

Advancements in Connectivity Technologies

The evolution of connectivity technologies is significantly influencing the Industrial Embedded System Market Industry. With the advent of 5G and enhanced wireless communication protocols, embedded systems are becoming more interconnected and capable of handling vast amounts of data. This connectivity enables seamless integration of devices and systems, fostering the development of smart factories and Industry 4.0 initiatives. As industries seek to harness the power of data analytics and real-time monitoring, the demand for advanced embedded systems that support these technologies is expected to increase. The ability to connect and communicate effectively is thus a pivotal driver in the Industrial Embedded System Market Industry.