Healthcare Innovations

The healthcare sector is rapidly adopting embedded systems to improve patient care and streamline operations. From medical devices to telehealth solutions, embedded systems are integral to enhancing diagnostic capabilities and monitoring patient health. The Global Embedded Systems Market Industry is benefiting from this trend, as healthcare providers seek to leverage technology for better outcomes. Innovations such as wearable health monitors and smart medical devices are becoming commonplace, driving demand for embedded solutions. This growth is indicative of a broader shift towards technology-driven healthcare, which is likely to expand the market significantly in the coming years.

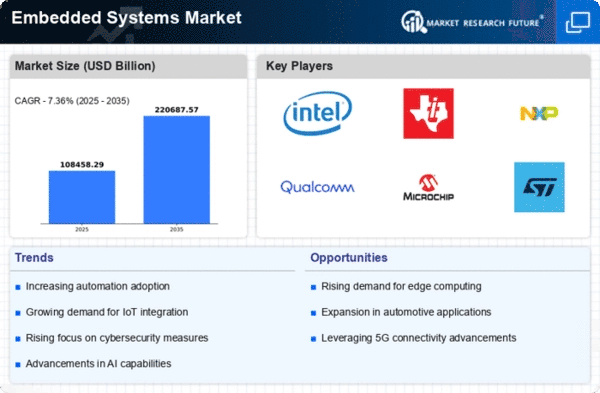

Market Growth Projections

The Global Embedded Systems Market Industry is poised for substantial growth in the coming years. Projections indicate that the market will reach 136.0 USD Billion in 2024 and is expected to expand to 229.6 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 4.88% from 2025 to 2035. The increasing integration of embedded systems across various sectors, including automotive, healthcare, and telecommunications, underscores the market's potential. As industries continue to innovate and adopt advanced technologies, the embedded systems market is likely to thrive, driven by evolving consumer demands and technological advancements.

Rising Demand for Smart Devices

The increasing proliferation of smart devices across various sectors is a primary driver of the Global Embedded Systems Market Industry. As consumers and businesses alike seek enhanced functionality and connectivity, the demand for embedded systems in smartphones, wearables, and home automation devices continues to surge. In 2024, the market is projected to reach 136.0 USD Billion, reflecting a robust growth trajectory. This trend is likely to persist as advancements in Internet of Things (IoT) technology further integrate embedded systems into everyday applications, thereby expanding their market presence and driving innovation.

Automotive Sector Transformation

The automotive industry is undergoing a significant transformation, largely fueled by the integration of embedded systems. With the rise of electric vehicles and autonomous driving technologies, the Global Embedded Systems Market Industry is experiencing heightened demand for sophisticated embedded solutions. These systems are essential for managing vehicle functions, enhancing safety features, and improving overall user experience. As the automotive sector evolves, it is anticipated that the market will grow substantially, potentially reaching 229.6 USD Billion by 2035. This shift indicates a strong correlation between automotive advancements and the embedded systems market.

Industrial Automation and Control

Industrial automation is a critical driver for the Global Embedded Systems Market Industry, as manufacturers increasingly adopt smart technologies to enhance operational efficiency. Embedded systems play a vital role in automating processes, monitoring equipment, and ensuring quality control. The push towards Industry 4.0 is propelling investments in embedded solutions, which are essential for real-time data processing and analytics. As industries strive for greater productivity and reduced operational costs, the embedded systems market is expected to witness a compound annual growth rate of 4.88% from 2025 to 2035, underscoring the importance of these technologies in modern manufacturing.

Telecommunications Infrastructure Development

The expansion of telecommunications infrastructure is a significant driver for the Global Embedded Systems Market Industry. As global connectivity increases, the demand for embedded systems in networking equipment, routers, and communication devices is on the rise. These systems are crucial for managing data traffic and ensuring reliable communication services. With the rollout of 5G technology, the need for advanced embedded solutions is expected to escalate, facilitating faster and more efficient data transmission. This trend highlights the interdependence between telecommunications advancements and the embedded systems market, suggesting a robust growth outlook.