Growing Environmental Regulations

The Industrial Electric Vehicle Market is increasingly shaped by growing environmental regulations aimed at reducing carbon emissions and promoting cleaner technologies. Governments worldwide are implementing stricter emissions standards, compelling industries to adopt more sustainable practices. Electric vehicles, with their zero tailpipe emissions, are well-positioned to meet these regulatory requirements. As industries face mounting pressure to comply with environmental standards, the transition to electric vehicles becomes not just a choice but a necessity. Data suggests that sectors such as manufacturing and logistics are particularly affected, as they are significant contributors to greenhouse gas emissions. The Industrial Electric Vehicle Market is thus likely to expand as companies seek to align their operations with regulatory expectations and enhance their corporate sustainability profiles.

Government Incentives and Subsidies

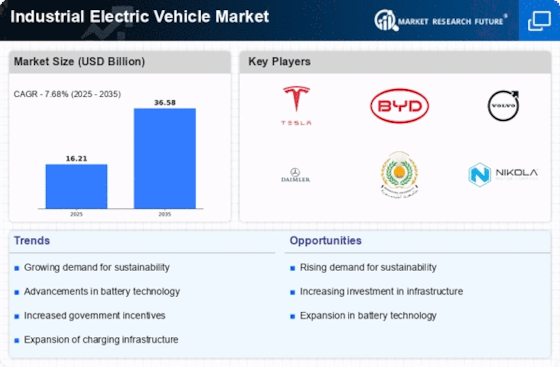

The Industrial Electric Vehicle Market is significantly influenced by government incentives and subsidies aimed at promoting the adoption of electric vehicles. Various governments have implemented financial incentives, such as tax credits and grants, to encourage businesses to transition to electric fleets. For instance, some regions offer rebates that can cover a substantial portion of the purchase price of electric vehicles. This financial support not only lowers the initial investment barrier but also enhances the overall attractiveness of electric vehicles in industrial applications. Additionally, regulatory frameworks are evolving to favor electric vehicles, with many jurisdictions setting ambitious targets for emissions reductions. As a result, the Industrial Electric Vehicle Market is likely to see accelerated growth as businesses capitalize on these incentives to modernize their operations and comply with emerging regulations.

Increased Focus on Supply Chain Resilience

The Industrial Electric Vehicle Market is benefiting from an increased focus on supply chain resilience, particularly in the wake of recent disruptions. Companies are reevaluating their logistics strategies to ensure continuity and reliability in their operations. Electric vehicles are emerging as a key component of this strategy, offering advantages such as lower maintenance costs and reduced dependency on fossil fuels. The shift towards electric vehicles can enhance supply chain flexibility, allowing businesses to adapt more swiftly to changing market conditions. Furthermore, the integration of electric vehicles into supply chains can contribute to improved operational efficiency, as they often require less downtime compared to traditional vehicles. As industries prioritize resilience and adaptability, the Industrial Electric Vehicle Market is likely to see a sustained increase in demand for electric vehicles as a strategic asset.

Rising Demand for Efficient Logistics Solutions

The Industrial Electric Vehicle Market is experiencing a notable surge in demand for efficient logistics solutions. As industries strive to optimize their supply chains, electric vehicles are increasingly recognized for their ability to reduce operational costs and enhance productivity. According to recent data, the adoption of electric vehicles in logistics can lead to a reduction in fuel costs by up to 30%. This economic incentive, coupled with the growing emphasis on sustainability, positions electric vehicles as a viable alternative to traditional combustion engines. Furthermore, the shift towards e-commerce has intensified the need for last-mile delivery solutions, where electric vehicles can play a pivotal role. The Industrial Electric Vehicle Market is thus likely to benefit from this trend, as companies seek to modernize their fleets and meet consumer expectations for faster and greener delivery options.

Technological Innovations in Battery Technology

The Industrial Electric Vehicle Market is poised for growth due to ongoing technological innovations in battery technology. Advances in battery efficiency, energy density, and charging speed are transforming the landscape of electric vehicles. For instance, the development of solid-state batteries promises to enhance the range and safety of electric vehicles, making them more appealing for industrial applications. Current trends indicate that battery costs have decreased significantly, with projections suggesting a further decline in the coming years. This reduction in costs is crucial for the Industrial Electric Vehicle Market, as it directly impacts the overall affordability of electric vehicles. Moreover, improved battery technologies are likely to extend the operational capabilities of electric vehicles, enabling longer usage periods and reducing downtime. Consequently, these advancements may catalyze a broader adoption of electric vehicles across various industrial sectors.