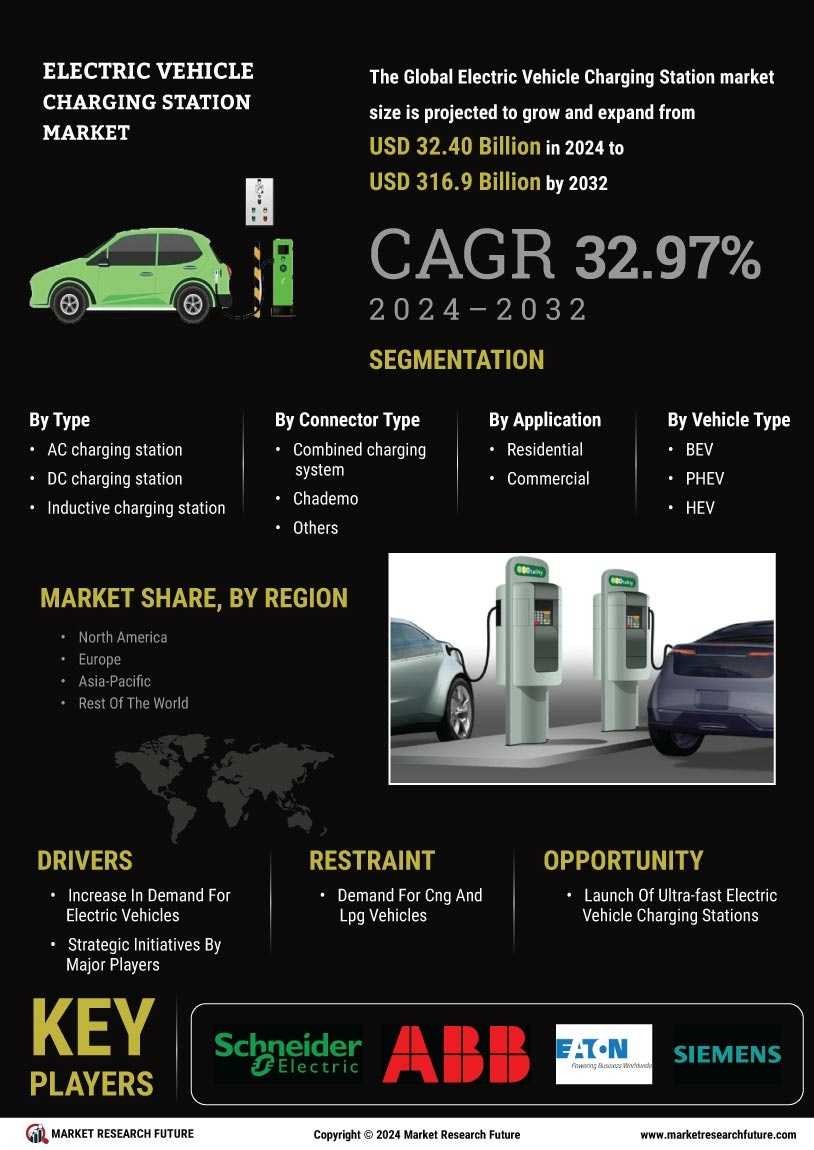

Rising Electric Vehicle Adoption

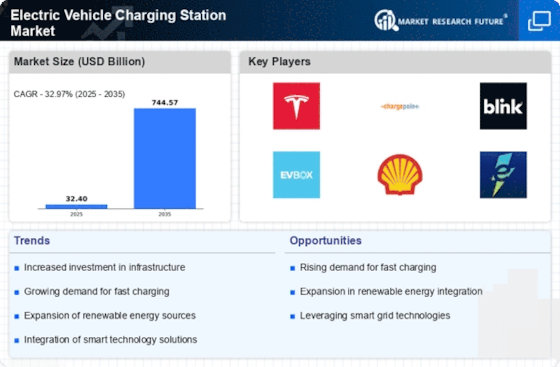

The increasing adoption of electric vehicles (EVs) is a primary driver for the Electric Vehicle Charging Station Market. As consumers become more environmentally conscious, the demand for EVs has surged, with sales reaching approximately 10 million units in 2025. This trend is expected to continue, as more manufacturers introduce electric models, thereby expanding the consumer base. The growth in EV adoption necessitates a corresponding increase in charging infrastructure, which directly impacts the Electric Vehicle Charging Station Market. Furthermore, as battery technology improves, the range of EVs is expected to increase, further encouraging consumers to switch from traditional vehicles to electric ones. This shift not only supports sustainability goals but also stimulates economic growth within the sector.

Government Regulations and Support

Government regulations and support are pivotal in driving the Electric Vehicle Charging Station Market. Many governments are implementing stringent emissions regulations, which encourage the transition to electric vehicles. In addition, various countries are offering incentives such as tax credits, rebates, and grants for both consumers and businesses investing in EV infrastructure. For example, the United States has allocated billions in funding to expand charging networks, aiming to install 500,000 charging stations by 2030. Such initiatives not only promote the adoption of electric vehicles but also stimulate the growth of the charging station market. The alignment of government policies with environmental goals is likely to create a favorable environment for the Electric Vehicle Charging Station Market.

Investment in Renewable Energy Sources

The shift towards renewable energy sources is increasingly influencing the Electric Vehicle Charging Station Market. As more charging stations are powered by solar, wind, and other renewable energy sources, the overall carbon footprint of electric vehicles is reduced, making them a more attractive option for consumers. This trend is supported by various initiatives aimed at promoting sustainable energy solutions. For instance, many charging stations are now being designed to integrate solar panels, which can significantly lower operational costs and enhance energy efficiency. The synergy between renewable energy and electric vehicle charging infrastructure is expected to bolster the market, as consumers become more aware of the environmental benefits associated with using clean energy for charging their vehicles.

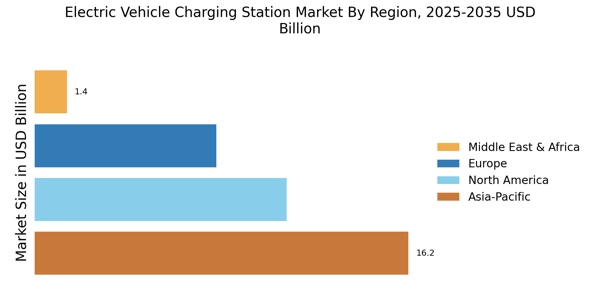

Urbanization and Infrastructure Development

Urbanization and infrastructure development are key factors driving the Electric Vehicle Charging Station Market. As urban populations grow, the demand for efficient transportation solutions increases, leading to a higher adoption of electric vehicles. Cities are increasingly recognizing the need for robust charging infrastructure to support this transition. The development of smart cities, which incorporate EV charging stations into their planning, is becoming more prevalent. For example, many urban areas are integrating charging stations into public parking facilities and along major roadways to enhance accessibility. This strategic placement of charging infrastructure is likely to facilitate the growth of the Electric Vehicle Charging Station Market, as it addresses the needs of urban dwellers who are adopting electric vehicles.

Technological Advancements in Charging Solutions

Technological advancements play a crucial role in shaping the Electric Vehicle Charging Station Market. Innovations such as fast charging technology and wireless charging solutions are enhancing the user experience and reducing charging times significantly. For instance, ultra-fast charging stations can deliver up to 350 kW, allowing EVs to charge to 80% in under 30 minutes. This rapid development in charging technology is likely to attract more consumers to electric vehicles, thereby increasing the demand for charging stations. Additionally, the integration of smart technology, such as mobile apps for locating charging stations and monitoring charging status, is further driving the market. As these technologies evolve, they are expected to create a more efficient and user-friendly charging ecosystem.