Emergence of New Technologies

The emergence of new technologies, such as 5G and edge computing, is poised to transform The India Wireless Network Infrastructure Ecosystem Market. 5G technology, in particular, promises to deliver unprecedented speeds and lower latency, enabling a wide range of applications from autonomous vehicles to enhanced mobile broadband. The Indian telecom sector is actively preparing for the rollout of 5G services, with trials already underway in various cities. This technological shift is expected to drive significant investments in infrastructure upgrades and expansions, as operators strive to meet the demands of next-generation applications. As a result, the India wireless network infrastructure ecosystem market is likely to witness a surge in innovation and competition among service providers.

Increased Investment in Cybersecurity

As the reliance on wireless networks grows, so does the need for robust cybersecurity measures within The India Wireless Network Infrastructure Ecosystem Market. With the increasing frequency of cyber threats and data breaches, telecom operators and service providers are compelled to invest in advanced security solutions to protect their networks and customer data. The government has also recognized the importance of cybersecurity, implementing policies to enhance the security framework of digital communications. This focus on cybersecurity not only safeguards the integrity of wireless networks but also instills consumer confidence, thereby driving further adoption of wireless services. Consequently, the emphasis on cybersecurity is likely to play a crucial role in shaping the future of the India wireless network infrastructure ecosystem market.

Rise of Smart Cities and Urbanization

The rapid urbanization and the rise of smart cities in India are driving the demand for advanced wireless network infrastructure. As urban populations grow, the need for efficient communication systems becomes increasingly critical. The Smart Cities Mission, launched by the Indian government, aims to develop 100 smart cities across the country, integrating technology into urban planning and management. This initiative is expected to create a substantial demand for wireless infrastructure, as smart cities rely heavily on IoT devices and real-time data analytics. Consequently, investments in The India Wireless Network Infrastructure Ecosystem Market are likely to increase, as stakeholders seek to build the necessary frameworks to support these urban developments.

Growing Demand for High-Speed Connectivity

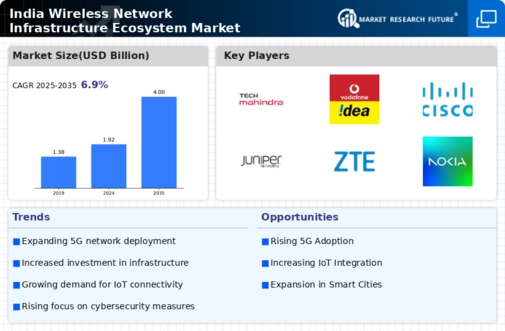

The increasing demand for high-speed connectivity in The India Wireless Network Infrastructure Ecosystem Market appears to be a primary driver. With the proliferation of digital services and online platforms, consumers and businesses alike are seeking faster and more reliable internet access. According to recent data, the number of internet users in India has surpassed 800 million, indicating a substantial market for enhanced wireless infrastructure. This surge in demand necessitates the expansion and upgrading of existing network infrastructure, thereby propelling investments in the sector. As a result, telecom operators are likely to prioritize the deployment of advanced technologies, such as 5G, to meet consumer expectations and remain competitive in the evolving landscape.

Government Support and Regulatory Framework

The role of government support and a robust regulatory framework in The India Wireless Network Infrastructure Ecosystem Market cannot be overstated. The Indian government has introduced various initiatives aimed at promoting digital connectivity, such as the National Digital Communications Policy, which aims to provide broadband access to all citizens by 2022. This policy framework encourages private sector investment in wireless infrastructure, fostering a conducive environment for growth. Furthermore, the government's push for Make in India initiatives is likely to stimulate local manufacturing of network equipment, reducing dependency on imports. Such measures not only enhance the infrastructure landscape but also contribute to job creation and economic growth within the sector.