Growing Automotive Sector

The India Tyre Manufacturers Market is experiencing a robust growth trajectory, primarily driven by the expanding automotive sector. With the Indian government promoting initiatives such as 'Make in India', the production of vehicles has surged. In 2025, the country produced over 4 million passenger vehicles, indicating a strong demand for tyres. This growth in vehicle production directly correlates with an increased need for tyres, as each vehicle requires multiple tyres. Furthermore, the rise in disposable income among consumers has led to a greater inclination towards personal vehicle ownership, further propelling the demand for tyres. As the automotive sector continues to flourish, tyre manufacturers are likely to benefit from this upward trend, positioning themselves strategically to cater to the evolving needs of the market.

Expansion of Distribution Networks

The expansion of distribution networks is a crucial driver for the India Tyre Manufacturers Market, facilitating greater accessibility of tyres to consumers across the country. As urbanization accelerates and the number of retail outlets increases, manufacturers are strategically enhancing their distribution channels to reach a wider audience. The rise of e-commerce platforms has also transformed the way tyres are marketed and sold, allowing consumers to purchase tyres online with ease. In 2025, the online tyre sales segment has grown by approximately 25%, reflecting changing consumer purchasing behaviors. This expansion not only boosts sales for manufacturers but also enhances brand visibility and customer engagement. As distribution networks continue to evolve, tyre manufacturers are likely to capitalize on these trends to strengthen their market presence.

Government Regulations and Policies

The regulatory landscape surrounding the India Tyre Manufacturers Market plays a pivotal role in shaping its dynamics. The Indian government has implemented stringent regulations aimed at enhancing safety and environmental standards in tyre manufacturing. For instance, the Bureau of Indian Standards (BIS) has established guidelines that manufacturers must adhere to, ensuring that tyres meet quality and safety benchmarks. Additionally, the government's push for sustainable practices has led to incentives for manufacturers who adopt eco-friendly production methods. This regulatory framework not only fosters a competitive environment but also encourages innovation within the industry. As manufacturers align their operations with these regulations, they are likely to enhance their market position while contributing to a safer and more sustainable automotive ecosystem.

Rising Demand for Electric Vehicles

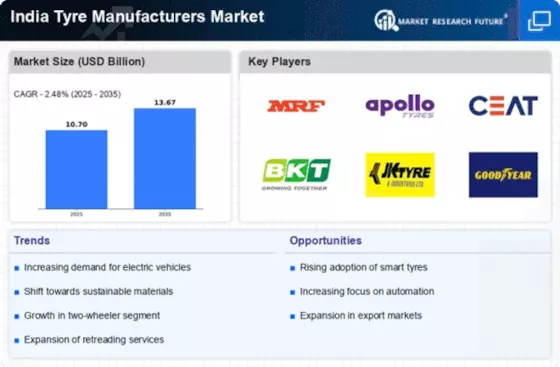

The increasing adoption of electric vehicles (EVs) in India is emerging as a significant driver for the India Tyre Manufacturers Market. With the government's ambitious target of having 30% of all vehicles on the road being electric by 2030, tyre manufacturers are compelled to innovate and develop tyres specifically designed for EVs. These tyres require unique characteristics, such as lower rolling resistance and enhanced durability, to accommodate the distinct performance needs of electric vehicles. As of 2025, the EV market in India has witnessed a growth rate of over 40%, indicating a substantial shift in consumer preferences. This trend presents a lucrative opportunity for tyre manufacturers to diversify their product offerings and cater to the evolving demands of the automotive landscape.

Technological Innovations in Tyre Manufacturing

Technological advancements are significantly influencing the India Tyre Manufacturers Market, as manufacturers increasingly adopt innovative production techniques. The integration of automation and artificial intelligence in manufacturing processes has led to enhanced efficiency and precision in tyre production. Moreover, advancements in materials science have enabled the development of high-performance tyres that offer improved safety and longevity. For instance, the introduction of smart tyres equipped with sensors for real-time monitoring of tyre pressure and temperature is gaining traction. These innovations not only enhance the performance of tyres but also align with the growing consumer demand for safety and reliability. As manufacturers continue to invest in research and development, the industry is likely to witness a transformation that could redefine tyre performance standards.