Focus on Operational Efficiency

In the Rubber Tyre Gantry Crane Market, there is a pronounced focus on enhancing operational efficiency. Companies are increasingly recognizing that the integration of advanced technologies, such as automation and real-time data analytics, can significantly improve crane performance. This trend is reflected in the growing adoption of rubber tyre gantry cranes equipped with smart features that allow for better load management and reduced downtime. The market is expected to witness a shift towards cranes that not only provide mobility but also optimize energy consumption and reduce operational costs. As organizations strive to streamline their operations, the demand for efficient and technologically advanced rubber tyre gantry cranes is likely to rise, further propelling the market forward.

Expansion of Port Infrastructure

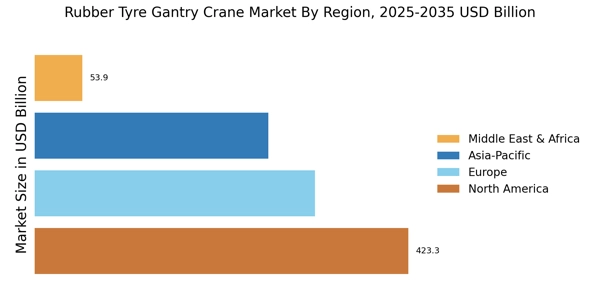

The Rubber Tyre Gantry Crane Market is benefiting from the ongoing expansion of port infrastructure across various regions. Governments and private entities are investing heavily in upgrading and expanding port facilities to accommodate larger vessels and increased cargo volumes. This expansion necessitates the deployment of modern handling equipment, including rubber tyre gantry cranes, which are essential for efficient cargo movement. Recent reports indicate that several countries are planning to enhance their port capacities, which is expected to drive the demand for rubber tyre gantry cranes. As ports evolve to meet the challenges of modern shipping, the industry is likely to see a surge in orders for these cranes, thereby contributing to market growth.

Rising Environmental Regulations

The Rubber Tyre Gantry Crane Market is increasingly influenced by rising environmental regulations aimed at reducing carbon emissions and promoting sustainability. As industries face stricter environmental standards, there is a growing emphasis on adopting equipment that minimizes ecological impact. Rubber tyre gantry cranes, known for their lower emissions compared to traditional cranes, are becoming a preferred choice for many operators. The market is witnessing a shift towards eco-friendly models that comply with these regulations, which may include electric or hybrid cranes. This trend not only aligns with The Rubber Tyre Gantry Crane Market appeal of rubber tyre gantry cranes, as companies seek to improve their environmental footprint while maintaining operational efficiency.

Increased Demand for Container Handling

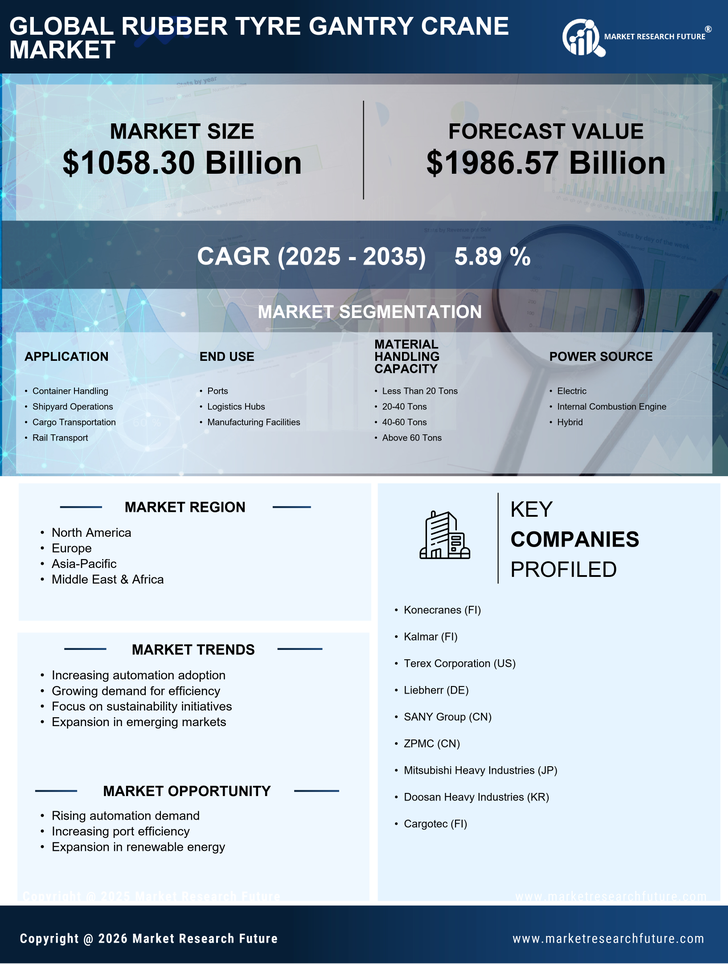

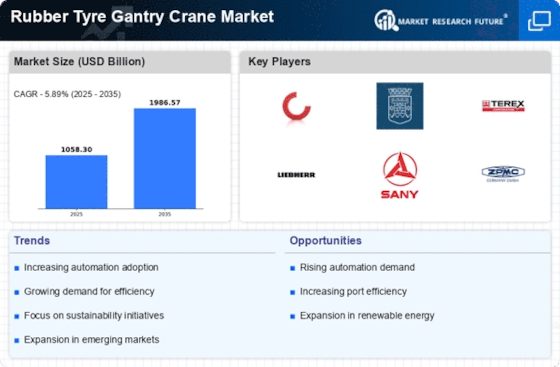

The Rubber Tyre Gantry Crane Market is experiencing heightened demand due to the growing need for efficient container handling in ports and terminals. As global trade continues to expand, the volume of containers transported has surged, necessitating advanced equipment to manage this influx. The market for rubber tyre gantry cranes is projected to grow at a compound annual growth rate of approximately 5.2% over the next few years. This growth is driven by the need for faster turnaround times and improved operational efficiency in container handling. Furthermore, the flexibility and mobility offered by rubber tyre gantry cranes make them an attractive option for terminal operators looking to optimize space and resources. As a result, the industry is likely to see increased investments in these cranes to meet the rising demands of container logistics.

Technological Innovations in Crane Design

Technological innovations are playing a pivotal role in shaping the Rubber Tyre Gantry Crane Market. Recent advancements in crane design, such as improved lifting mechanisms and enhanced control systems, are making rubber tyre gantry cranes more efficient and user-friendly. These innovations are likely to attract new customers and retain existing ones, as operators seek to leverage the latest technology for better performance. The introduction of features like remote operation and predictive maintenance capabilities is expected to further enhance the appeal of these cranes. As the industry continues to evolve, the integration of cutting-edge technology into rubber tyre gantry cranes will likely drive market growth, positioning these cranes as essential tools in modern logistics and material handling.