Expansion of Telehealth Services

The expansion of telehealth services is emerging as a pivotal driver in the Healthcare OEM Manufacturers Market. As healthcare providers increasingly adopt telemedicine solutions, there is a growing need for medical devices that facilitate remote consultations and monitoring. This trend is underscored by the rising acceptance of telehealth among patients, with studies indicating that over 70% of patients are willing to use telehealth services for non-emergency consultations. OEM manufacturers are capitalizing on this shift by developing devices that integrate seamlessly with telehealth platforms, such as remote monitoring tools and diagnostic equipment. This integration not only enhances the accessibility of healthcare services but also supports the ongoing trend towards patient-centered care. As telehealth continues to evolve, it is likely to drive innovation and growth within the Healthcare OEM Manufacturers Market.

Growing Focus on Preventive Healthcare

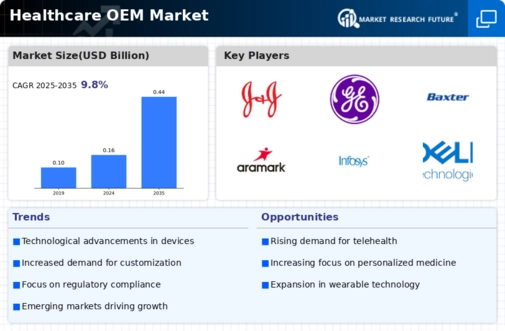

The shift towards preventive healthcare is significantly influencing the Healthcare OEM Manufacturers Market. As healthcare systems worldwide emphasize early detection and prevention of diseases, there is an increasing demand for diagnostic and monitoring devices. This trend is reflected in the rising investments in wearable health technologies and remote patient monitoring systems. According to industry reports, the market for wearable medical devices is expected to grow at a compound annual growth rate of over 20% in the coming years. OEM manufacturers are responding to this demand by developing innovative solutions that empower patients to take charge of their health. This focus on preventive care not only enhances patient engagement but also reduces the overall burden on healthcare systems, thereby driving growth within the Healthcare OEM Manufacturers Market.

Rising Demand for Advanced Medical Devices

The Healthcare OEM Manufacturers Market is experiencing a notable increase in demand for advanced medical devices. This trend is driven by the growing prevalence of chronic diseases and an aging population, which necessitate innovative healthcare solutions. According to recent data, the market for medical devices is projected to reach USD 600 billion by 2025, indicating a robust growth trajectory. As healthcare providers seek to enhance patient outcomes, OEM manufacturers are compelled to invest in research and development to create cutting-edge technologies. This demand for advanced devices not only fosters competition among manufacturers but also encourages collaboration with healthcare providers to tailor solutions that meet specific clinical needs. Consequently, the Healthcare OEM Manufacturers Market is poised for significant expansion as it adapts to these evolving demands.

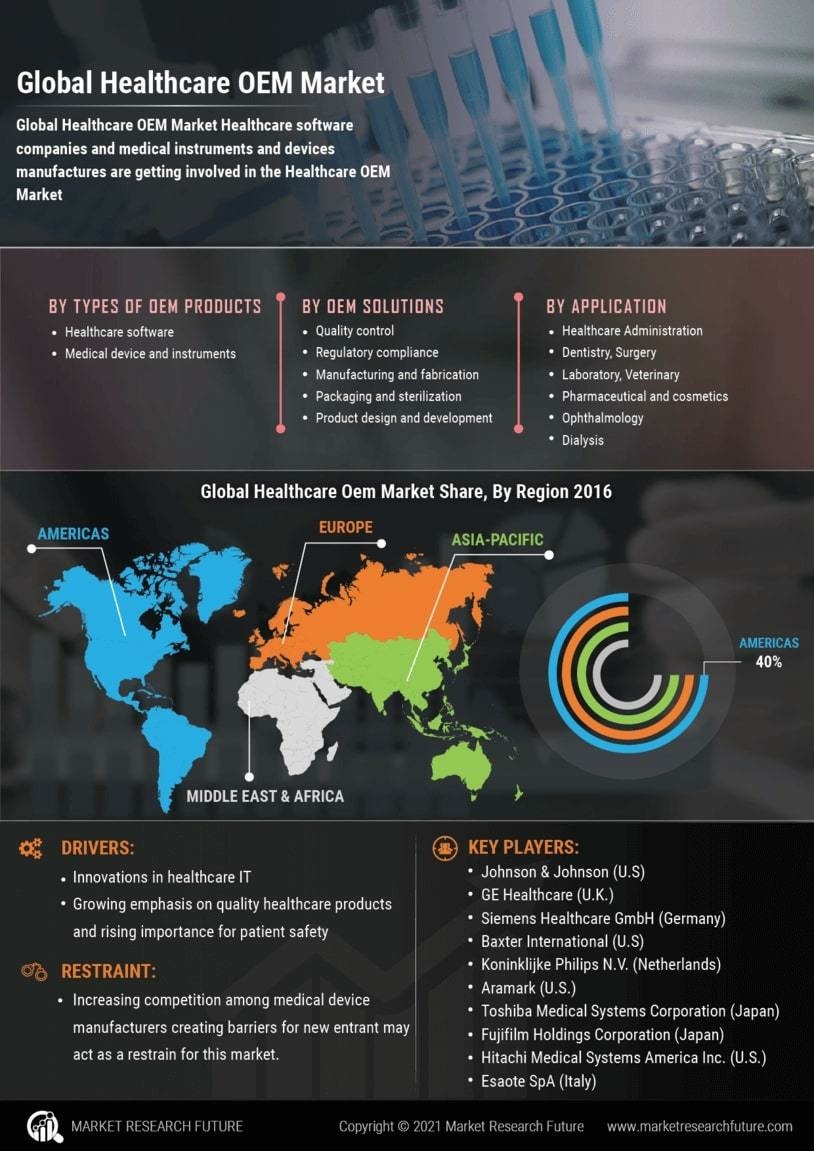

Regulatory Compliance and Quality Standards

Regulatory compliance remains a critical driver in the Healthcare OEM Manufacturers Market, as manufacturers must adhere to stringent quality standards set by health authorities. The increasing focus on patient safety and product efficacy has led to the establishment of rigorous regulatory frameworks. For example, the FDA and other regulatory bodies have implemented comprehensive guidelines that OEM manufacturers must follow to ensure their products meet safety and performance criteria. This emphasis on compliance not only protects patients but also enhances the credibility of manufacturers in the marketplace. As a result, companies that prioritize regulatory adherence are likely to gain a competitive edge, fostering trust among healthcare providers and patients alike. The ongoing evolution of these regulations will continue to shape the operational strategies within the Healthcare OEM Manufacturers Market.

Technological Advancements in Manufacturing Processes

Technological advancements are reshaping the Healthcare OEM Manufacturers Market, leading to more efficient and precise manufacturing processes. Innovations such as 3D printing, automation, and artificial intelligence are streamlining production, reducing costs, and improving product quality. For instance, 3D printing allows for the rapid prototyping of medical devices, enabling manufacturers to respond swiftly to market needs. The integration of automation in assembly lines enhances productivity and minimizes human error, which is crucial in the production of medical devices that require high precision. As these technologies continue to evolve, they are likely to drive down production costs while increasing the speed of bringing new products to market. This dynamic environment presents both challenges and opportunities for OEM manufacturers as they navigate the complexities of the Healthcare OEM Manufacturers Market.