Increasing Regulatory Scrutiny

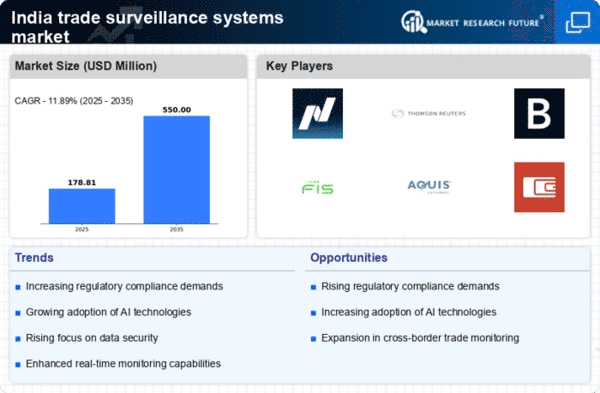

The trade surveillance-systems market in India is experiencing heightened regulatory scrutiny, driven by the need for compliance with stringent financial regulations. Regulatory bodies such as the Securities and Exchange Board of India (SEBI) are enforcing rigorous guidelines to ensure market integrity and protect investors. This has led to a growing demand for advanced surveillance systems that can monitor trading activities in real-time. As a result, firms are investing in sophisticated technologies to enhance their compliance capabilities. The market is projected to grow at a CAGR of approximately 15% over the next five years, reflecting the increasing importance of regulatory compliance in the trade surveillance-systems market.

Demand for Enhanced Data Analytics

The demand for enhanced data analytics capabilities is a crucial driver of the trade surveillance-systems market in India. Financial institutions are increasingly seeking solutions that provide deeper insights into trading behaviors and market trends. Advanced analytics tools enable firms to process and interpret large datasets, facilitating more informed decision-making and risk management. As the complexity of trading environments grows, the need for sophisticated analytics becomes more pronounced. This trend is likely to result in a compound annual growth rate of around 14% in the trade surveillance-systems market, as institutions strive to harness data for improved operational efficiency and compliance.

Rising Incidences of Market Manipulation

The trade surveillance-systems market is significantly influenced by the rising incidences of market manipulation in India. As trading volumes increase, so does the potential for fraudulent activities such as insider trading and spoofing. This has prompted financial institutions to adopt robust surveillance systems to detect and prevent such malpractices. The need for effective monitoring solutions is underscored by the fact that regulatory penalties for non-compliance can reach millions of dollars. Consequently, firms are prioritizing investments in trade surveillance technologies to safeguard their operations and maintain market integrity, thereby driving growth in the trade surveillance-systems market.

Technological Integration and Innovation

Technological integration and innovation are pivotal drivers of the trade surveillance-systems market in India. The advent of artificial intelligence (AI) and machine learning (ML) technologies has revolutionized the way trading activities are monitored. These technologies enable firms to analyze vast amounts of data quickly and accurately, identifying suspicious patterns that may indicate fraudulent behavior. As financial institutions increasingly recognize the value of these advanced technologies, the demand for innovative surveillance solutions is expected to rise. The trade surveillance-systems market is likely to witness a surge in investments, with projections indicating a growth rate of around 12% annually as firms seek to leverage technology for enhanced monitoring capabilities.

Growing Awareness of Cybersecurity Threats

The trade surveillance-systems market is also being propelled by the growing awareness of cybersecurity threats among financial institutions in India. As cyberattacks become more sophisticated, firms are recognizing the necessity of implementing comprehensive surveillance systems to protect sensitive trading data. The increasing frequency of data breaches has led to a heightened focus on cybersecurity measures, prompting institutions to invest in trade surveillance technologies that incorporate robust security features. This trend is expected to contribute to a market growth rate of approximately 10% over the next few years, as firms prioritize the safeguarding of their trading environments against potential cyber threats.