Growing Geriatric Population

The growing geriatric population in India is a significant driver for the sleep apnea-devices market. As the population ages, the incidence of sleep apnea tends to increase, primarily due to age-related physiological changes and comorbidities. It is estimated that around 10-20% of older adults suffer from sleep apnea, which necessitates effective treatment solutions. This demographic shift is prompting healthcare providers to focus on diagnosing and managing sleep disorders among the elderly. Consequently, the demand for sleep apnea devices, such as CPAP machines and monitoring systems, is likely to rise. The sleep apnea-devices market stands to benefit from this trend, as manufacturers tailor their products to meet the specific needs of older patients.

Rising Prevalence of Sleep Disorders

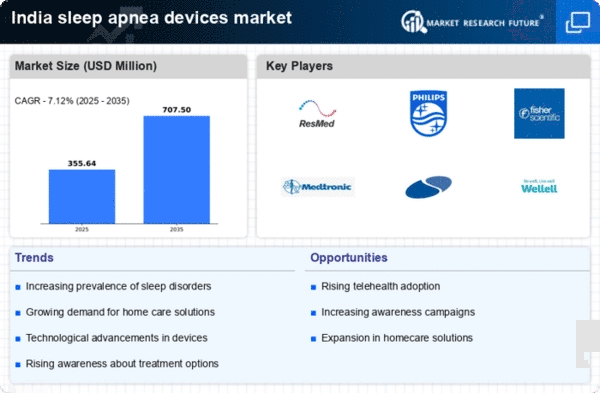

The increasing prevalence of sleep disorders in India is a crucial driver for the sleep apnea-devices market. Studies indicate that approximately 30% of the Indian population experiences some form of sleep disorder, with sleep apnea being a significant contributor. This rising incidence is attributed to lifestyle changes, urbanization, and increased stress levels. As awareness grows regarding the health implications of untreated sleep apnea, more individuals seek diagnosis and treatment. Consequently, this trend is likely to boost demand for various sleep apnea devices, including CPAP machines and oral appliances, thereby expanding the market. The sleep apnea-devices market is expected to witness substantial growth as healthcare providers emphasize the importance of addressing sleep disorders to improve overall health outcomes.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare in India, which serves as a vital driver for the sleep apnea-devices market. As healthcare systems evolve, there is a shift towards proactive management of health issues, including sleep disorders. This trend is reflected in the increasing number of health screenings and awareness campaigns aimed at identifying sleep apnea early. Preventive healthcare initiatives encourage individuals to seek timely diagnosis and treatment, thereby driving demand for sleep apnea devices. The sleep apnea-devices market is likely to experience growth as more people recognize the importance of addressing sleep disorders to prevent associated health complications.

Government Initiatives and Health Policies

Government initiatives and health policies significantly influence the sleep apnea-devices market in India. The Indian government has been increasingly focusing on public health issues, including sleep disorders, which has led to the implementation of various health programs aimed at raising awareness and improving access to treatment. Policies promoting the integration of sleep medicine into primary healthcare systems are likely to enhance the availability of diagnostic tools and treatment options. Additionally, financial incentives for manufacturers and healthcare providers may stimulate market growth. As these initiatives gain traction, the sleep apnea-devices market is expected to expand, providing better access to essential devices for patients across the country.

Technological Innovations in Device Design

Technological innovations play a pivotal role in shaping the sleep apnea-devices market. Recent advancements in device design, such as the development of portable and user-friendly CPAP machines, have made treatment more accessible and appealing to patients. Innovations like automatic pressure adjustments and integrated humidifiers enhance user comfort and compliance. Furthermore, the introduction of smartphone applications for monitoring sleep patterns and device usage has revolutionized patient engagement. These technological enhancements not only improve treatment efficacy but also attract a broader consumer base. As manufacturers continue to invest in research and development, the sleep apnea-devices market is poised for growth, driven by the demand for advanced and efficient treatment options.