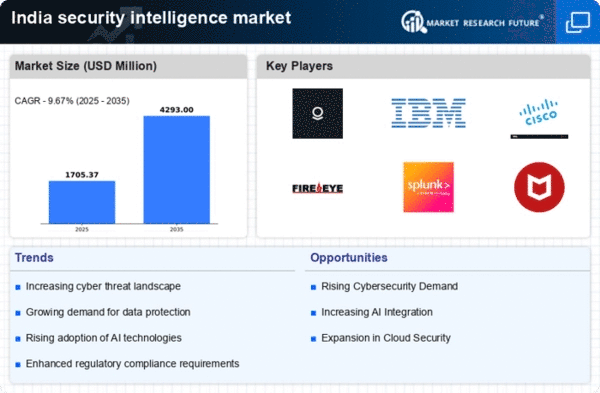

Rising Cyber Threats

The increasing frequency and sophistication of cyber threats in India is a primary driver for the security intelligence market. Organizations across various sectors are facing heightened risks from cybercriminals, leading to a surge in demand for advanced security solutions. According to recent data, cybercrime incidents in India have escalated by over 30% in the past year, prompting businesses to invest significantly in security intelligence systems. This trend indicates a growing recognition of the need for proactive measures to safeguard sensitive information and maintain operational integrity. As a result, the The security intelligence market is expected to expand rapidly. Companies are seeking to enhance their threat detection and response capabilities.

Increased Digital Transformation

The rapid digital transformation across industries in India is driving the demand for security intelligence solutions. As organizations adopt cloud computing, IoT, and big data analytics, the attack surface for cyber threats expands, necessitating enhanced security measures. A report indicates that over 70% of Indian businesses are prioritizing digital initiatives, which in turn fuels the need for comprehensive security intelligence systems. This trend suggests that as companies embrace digital technologies, they are also recognizing the importance of integrating security intelligence into their operations to mitigate risks. Consequently, the security intelligence market is poised for significant growth as businesses seek to protect their digital assets.

Growing Awareness of Data Privacy

There is a rising awareness of data privacy among consumers and businesses in India, which is influencing the security intelligence market. With increasing incidents of data breaches and stringent regulations, organizations are compelled to adopt robust security measures to protect sensitive information. Recent surveys indicate that approximately 65% of Indian consumers are concerned about their data privacy, prompting businesses to prioritize security intelligence solutions. This heightened awareness is likely to drive investments in security technologies, as companies strive to comply with regulations and build trust with their customers. The security intelligence market is expected to benefit from this trend as organizations seek to enhance their data protection strategies.

Emergence of Advanced Technologies

The emergence of advanced technologies such as artificial intelligence, machine learning, and blockchain is reshaping the security intelligence market in India. These technologies offer innovative solutions for threat detection, incident response, and data protection. As organizations increasingly adopt these technologies, the demand for security intelligence solutions that leverage them is likely to grow. For instance, AI-driven security systems can analyze vast amounts of data in real-time, enabling quicker identification of potential threats. This trend indicates a shift towards more sophisticated security measures, which could enhance the overall effectiveness of security intelligence solutions. Consequently, the market is expected to witness substantial growth as businesses seek to integrate these advanced technologies into their security frameworks.

Government Initiatives and Investments

The Indian government is actively promoting initiatives aimed at bolstering national security, which significantly impacts the security intelligence market. Programs such as Digital India and the National Cyber Security Policy are designed to enhance the country's cybersecurity infrastructure. The government has allocated substantial funding, estimated at $1 billion, to improve cybersecurity measures across various sectors. This financial commitment is likely to stimulate growth in the security intelligence market as public and private entities collaborate to implement advanced security solutions. Furthermore, the government's focus on developing a robust cybersecurity framework is expected to create a conducive environment for market expansion.