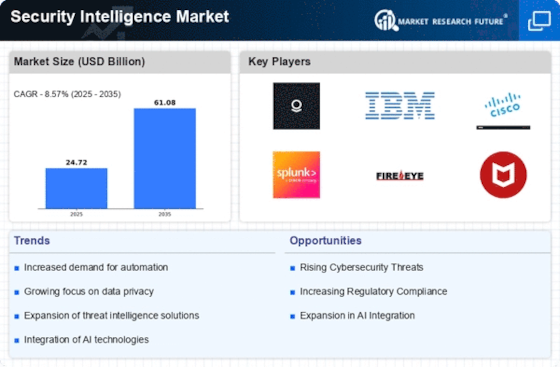

Rising Cyber Threats

The increasing frequency and sophistication of cyber threats is a primary driver for the Security Intelligence Market. Organizations are facing a myriad of cyber attacks, including ransomware, phishing, and advanced persistent threats. According to recent data, the number of reported cyber incidents has surged, prompting businesses to invest heavily in security intelligence solutions. This trend indicates a growing recognition of the need for proactive measures to safeguard sensitive information. As a result, the demand for advanced security intelligence tools that can detect, analyze, and respond to threats in real-time is likely to escalate. Companies are increasingly prioritizing investments in security intelligence to mitigate risks and ensure business continuity, thereby propelling the market forward.

Adoption of Cloud Technologies

The rapid adoption of cloud technologies is reshaping the Security Intelligence Market. As organizations migrate to cloud environments, they face unique security challenges that necessitate advanced security intelligence solutions. The cloud offers scalability and flexibility, but it also introduces vulnerabilities that can be exploited by cybercriminals. Consequently, businesses are investing in security intelligence tools that can provide visibility and protection across hybrid and multi-cloud environments. Market data suggests that the cloud security market is projected to grow significantly, reflecting the increasing reliance on cloud services. This shift is likely to drive demand for security intelligence solutions that can effectively monitor and secure cloud-based assets, ensuring that organizations can leverage the benefits of cloud computing without compromising security.

Emergence of Advanced Technologies

The emergence of advanced technologies such as artificial intelligence and machine learning is transforming the Security Intelligence Market. These technologies enable organizations to analyze vast amounts of data and identify patterns that may indicate potential threats. The integration of AI and machine learning into security intelligence solutions enhances the ability to detect anomalies and respond to incidents in real-time. As businesses seek to leverage these technologies to improve their security capabilities, the market for security intelligence solutions is expected to expand. The potential for automation in threat detection and response is particularly appealing, as it allows organizations to allocate resources more efficiently. This trend suggests that the adoption of advanced technologies will play a crucial role in shaping the future of the security intelligence landscape.

Regulatory Compliance Requirements

The evolving landscape of regulatory compliance is significantly influencing the Security Intelligence Market. Organizations are compelled to adhere to stringent regulations such as GDPR, HIPAA, and PCI DSS, which necessitate robust security measures. Compliance failures can result in severe penalties and reputational damage, driving companies to seek comprehensive security intelligence solutions. The market is witnessing a surge in demand for tools that facilitate compliance monitoring and reporting. As businesses strive to align their security practices with regulatory standards, the need for integrated security intelligence systems that provide visibility and control over data security is becoming increasingly apparent. This trend is expected to continue, as regulatory bodies enhance their oversight and enforcement capabilities.

Increased Investment in Cybersecurity

The heightened awareness of cybersecurity risks is leading to increased investment in the Security Intelligence Market. Organizations are recognizing that traditional security measures are insufficient to combat modern threats, prompting a shift towards more sophisticated security intelligence solutions. Recent statistics indicate that global spending on cybersecurity is expected to reach unprecedented levels, as businesses allocate more resources to enhance their security posture. This trend is indicative of a broader understanding that cybersecurity is not merely an IT issue but a critical component of overall business strategy. As organizations prioritize cybersecurity investments, the demand for advanced security intelligence tools that can provide actionable insights and threat intelligence is likely to grow, further propelling the market.