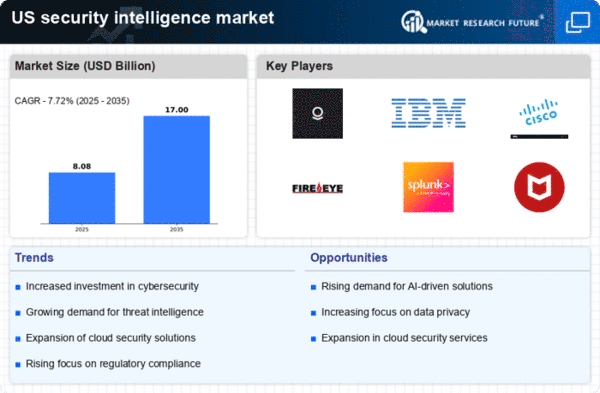

Rising Cyber Threats

The increasing frequency and sophistication of cyber threats is a primary driver for the security intelligence market. Organizations across various sectors are facing a surge in cyberattacks, which has led to a heightened demand for advanced security solutions. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually. This alarming trend compels companies to invest in security intelligence systems that can proactively identify and mitigate risks. The security intelligence market is thus experiencing significant growth as organizations seek to enhance their cybersecurity posture and protect sensitive data from breaches.

Advancements in Technology

Technological advancements play a crucial role in shaping the security intelligence market. Innovations in artificial intelligence, machine learning, and big data analytics are enabling organizations to process vast amounts of security data more efficiently. In 2025, the market for AI in cybersecurity is projected to reach $38 billion, indicating a robust growth trajectory. These technologies allow for real-time threat detection and response, which is essential in today's fast-paced digital landscape. As organizations increasingly adopt these advanced technologies, the security intelligence market is likely to expand, driven by the need for more sophisticated security solutions.

Expansion of Cloud Services

The rapid expansion of cloud services is significantly influencing the security intelligence market. As more organizations migrate their operations to the cloud, the need for robust security measures becomes paramount. In 2025, it is projected that cloud security spending will exceed $12 billion, highlighting the urgency for effective security intelligence solutions. This shift towards cloud-based infrastructures necessitates the implementation of advanced security protocols to protect against potential vulnerabilities. Consequently, the security intelligence market is poised for growth as businesses seek to secure their cloud environments and ensure the integrity of their data.

Growing Awareness of Data Privacy

As data breaches become more prevalent, there is a growing awareness among consumers and businesses regarding the importance of data privacy. This heightened awareness is driving organizations to prioritize security intelligence solutions that safeguard sensitive information. In 2025, it is anticipated that 70% of companies will have implemented comprehensive data protection strategies, reflecting a shift in focus towards proactive security measures. The security intelligence market is thus benefiting from this trend, as organizations seek to build trust with their customers by demonstrating a commitment to data privacy and security.

Increased Regulatory Requirements

The evolving regulatory landscape is a significant driver for the security intelligence market. Organizations are now required to comply with a myriad of regulations aimed at protecting consumer data and ensuring privacy. For instance, the implementation of the California Consumer Privacy Act (CCPA) has prompted businesses to enhance their security measures. In 2025, compliance-related spending in the security intelligence market is expected to rise by 25%, as companies invest in solutions that help them meet these stringent requirements. This trend underscores the importance of security intelligence in maintaining compliance and avoiding costly penalties.