Rising Cyber Threats

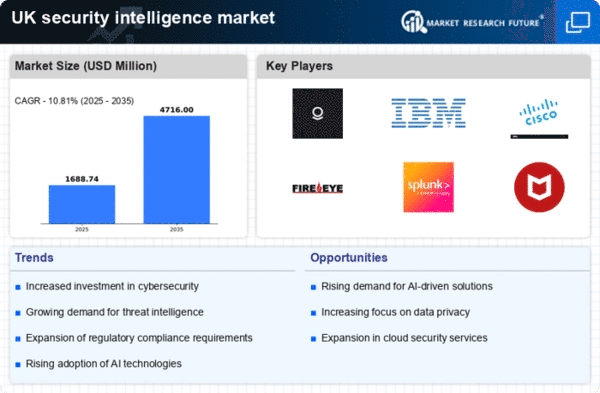

The security intelligence market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. In the UK, businesses are facing a surge in cyberattacks, with reports indicating a 30% rise in incidents over the past year. This alarming trend compels organizations to invest in advanced security intelligence solutions to protect sensitive data and maintain operational integrity. The need for proactive threat detection and response mechanisms is paramount, as the financial implications of breaches can be devastating, often costing companies millions in recovery efforts. Consequently, the security intelligence market is poised for growth as firms seek to bolster their defenses against evolving cyber threats.

Technological Advancements

The rapid evolution of technology is a significant driver for the security intelligence market. Innovations in artificial intelligence, machine learning, and big data analytics are transforming how organizations approach security. In the UK, the adoption of these technologies is projected to increase by 25% over the next five years, enhancing the capabilities of security intelligence solutions. These advancements enable more accurate threat detection, real-time monitoring, and automated responses, which are crucial for mitigating risks. As businesses strive to stay ahead of potential threats, the integration of cutting-edge technologies into security intelligence frameworks becomes essential, thereby propelling market growth.

Evolving Regulatory Landscape

The evolving regulatory landscape in the UK is a critical factor influencing the security intelligence market. With the introduction of stricter data protection laws and compliance requirements, organizations are compelled to adopt advanced security measures. The General Data Protection Regulation (GDPR) and the Data Protection Act 2018 have heightened the focus on data security, leading to increased scrutiny of security practices. As businesses strive to meet these regulatory demands, the need for effective security intelligence solutions becomes paramount. This regulatory pressure is likely to drive market growth as organizations seek to ensure compliance and avoid substantial fines.

Growing Awareness of Data Privacy

There is a growing awareness of data privacy among consumers and businesses in the UK, which is significantly impacting the security intelligence market. As individuals become more conscious of how their data is used and protected, organizations are under pressure to implement robust security measures. This shift in consumer expectations is prompting businesses to invest in security intelligence solutions that not only protect data but also enhance transparency and trust. The increasing emphasis on data privacy is likely to drive demand for security intelligence services, as companies recognize the importance of safeguarding customer information in maintaining their reputation and competitive edge.

Increased Investment in Security Infrastructure

Organizations in the UK are significantly increasing their investments in security infrastructure, which is a key driver for the security intelligence market. Recent data suggests that spending on cybersecurity solutions is expected to reach £10 billion by 2026, reflecting a growing recognition of the importance of robust security measures. This trend is driven by the need to protect against data breaches and comply with stringent regulations. As companies allocate more resources to enhance their security posture, the demand for comprehensive security intelligence solutions rises, indicating a robust growth trajectory for the market.