Increasing Cancer Awareness

The rising awareness regarding cancer and its treatment options is a pivotal driver for the pd l1-inhibitors market. Educational campaigns and initiatives by healthcare organizations in India have led to a heightened understanding of cancer symptoms and the importance of early detection. This awareness is likely to increase patient consultations and subsequently, the demand for advanced therapies, including pd l1-inhibitors. As more patients seek treatment, the market is projected to expand, with estimates suggesting a growth rate of approximately 15% annually. Furthermore, the increasing prevalence of various cancers, particularly lung and melanoma, is expected to further fuel the demand for these innovative therapies, thereby enhancing the overall landscape of the pd l1-inhibitors market.

Collaborations and Partnerships

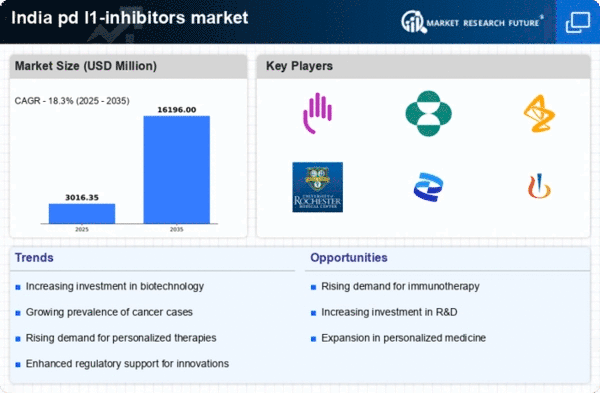

Strategic collaborations and partnerships among pharmaceutical companies, research institutions, and healthcare providers are emerging as a significant driver for the pd l1-inhibitors market. These alliances facilitate knowledge sharing, resource pooling, and accelerated development of new therapies. In India, several partnerships have been formed to enhance clinical trial capabilities and expedite the approval process for pd l1-inhibitors. Such collaborations not only enhance the research landscape but also improve market penetration of these therapies. The potential for shared expertise and resources may lead to a more robust pipeline of innovative products, thereby increasing market competitiveness. As a result, the pd l1-inhibitors market could experience a growth trajectory of approximately 18% in the coming years.

Growing Healthcare Infrastructure

The expansion of healthcare infrastructure in India is a crucial driver for the pd l1-inhibitors market. With the government prioritizing healthcare improvements, there has been a notable increase in the number of hospitals and cancer treatment centers equipped with advanced technologies. This enhanced infrastructure facilitates better access to innovative therapies, including pd l1-inhibitors, for patients across various regions. Moreover, the establishment of specialized oncology centers is likely to improve treatment outcomes and patient satisfaction. As healthcare accessibility improves, the market is projected to grow, with estimates indicating a potential increase in market size by 25% over the next five years. This growth reflects the increasing capacity to deliver cutting-edge cancer treatments within the pd l1-inhibitors market.

Government Initiatives and Policies

Government initiatives and policies aimed at improving cancer care are playing a vital role in shaping the pd l1-inhibitors market. The Indian government has implemented various programs to enhance cancer treatment accessibility and affordability, including subsidies for innovative therapies. These initiatives are likely to encourage the adoption of pd l1-inhibitors among healthcare providers and patients. Additionally, regulatory frameworks that support the expedited approval of new cancer therapies are expected to foster a conducive environment for market growth. As these policies take effect, the market may witness an increase in the utilization of pd l1-inhibitors, potentially leading to a market expansion of around 22% over the next few years. This supportive regulatory landscape is crucial for the sustained growth of the pd l1-inhibitors market.

Advancements in Research and Development

Ongoing advancements in research and development (R&D) are significantly influencing the pd l1-inhibitors market. Indian pharmaceutical companies are increasingly investing in R&D to develop novel therapies that target specific cancer types. This focus on innovation is likely to lead to the introduction of new pd l1-inhibitors, which could enhance treatment efficacy and patient outcomes. The Indian government has also been supportive of R&D initiatives, providing funding and incentives for biotech firms. As a result, the market is expected to witness a surge in new product launches, potentially increasing market revenue by 20% over the next few years. This dynamic environment fosters competition and encourages the development of more effective treatment options within the pd l1-inhibitors market.