Government Policies and Support

Government initiatives aimed at improving healthcare access are significantly influencing the India Ophthalmic Drugs Devices Market. The National Health Mission and various state-level programs are focused on enhancing eye care services, particularly in rural areas. These policies often include subsidized treatments and awareness campaigns, which encourage individuals to seek eye care. Furthermore, the government's push for Make in India has led to increased local manufacturing of ophthalmic devices, reducing costs and improving availability. Such supportive measures are likely to stimulate growth in the india ophthalmic drugs devices market, as they create a more favorable environment for both manufacturers and consumers.

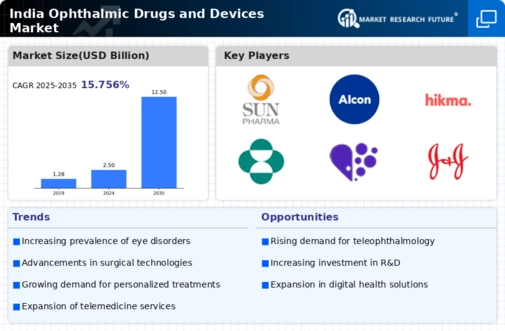

Increasing Prevalence of Eye Disorders

The rising incidence of eye disorders in India is a pivotal driver for the India Ophthalmic Drugs Devices Market. With an estimated 62 million people suffering from refractive errors and a significant number affected by cataracts and glaucoma, the demand for effective ophthalmic drugs and devices is surging. This trend is further exacerbated by the aging population, as older individuals are more susceptible to various eye conditions. The increasing prevalence of diabetes, which is linked to diabetic retinopathy, also contributes to the growing market. As awareness of these conditions rises, patients are more likely to seek treatment, thereby propelling the growth of the india ophthalmic drugs devices market.

Rising Consumer Awareness and Education

Consumer awareness regarding eye health is on the rise in India, which is positively impacting the India Ophthalmic Drugs Devices Market. Educational campaigns by non-governmental organizations and healthcare providers are informing the public about the importance of regular eye check-ups and early detection of eye diseases. This heightened awareness is leading to increased demand for ophthalmic drugs and devices, as individuals are more proactive in seeking treatment. Moreover, the proliferation of digital media has facilitated the dissemination of information, making it easier for consumers to understand their eye health needs. As awareness continues to grow, it is likely to drive further expansion in the india ophthalmic drugs devices market.

Technological Innovations in Ophthalmology

Technological advancements in ophthalmic devices are transforming the landscape of the India Ophthalmic Drugs Devices Market. Innovations such as minimally invasive surgical techniques, advanced diagnostic tools, and smart contact lenses are enhancing patient outcomes and driving market growth. For instance, the introduction of femtosecond lasers for cataract surgery has improved precision and reduced recovery times. Moreover, the integration of artificial intelligence in diagnostic equipment is streamlining the detection of eye diseases, making it more efficient. These technological innovations not only improve the quality of care but also attract investments, thereby fostering a competitive environment in the india ophthalmic drugs devices market.

Growing Investment in Healthcare Infrastructure

The expansion of healthcare infrastructure in India is a crucial driver for the India Ophthalmic Drugs Devices Market. With increasing investments in hospitals and clinics, particularly in tier-2 and tier-3 cities, access to eye care services is improving. This growth is supported by both public and private sectors, with numerous initiatives aimed at enhancing healthcare facilities. As more healthcare providers incorporate advanced ophthalmic devices and treatments, the market is expected to witness substantial growth. Additionally, the establishment of specialized eye hospitals is likely to increase the demand for innovative ophthalmic drugs and devices, further propelling the india ophthalmic drugs devices market.