Expansion of Smart Cities

The Indian government's initiative to develop smart cities is significantly influencing the optical transport-network market. As of November 2025, over 100 cities are undergoing transformation into smart cities, which requires advanced communication infrastructure. Optical transport networks are essential for supporting the high data demands of smart city applications, including IoT devices, smart grids, and real-time data analytics. The investment in these networks is projected to reach approximately $10 billion by 2027, indicating a strong growth trajectory. This expansion not only enhances urban connectivity but also drives the need for efficient data transmission, thereby propelling the optical transport-network market forward.

Focus on Network Security

In the context of increasing cyber threats, the optical transport-network market is witnessing a heightened focus on network security. As organizations in India prioritize the protection of sensitive data, the demand for secure optical transport solutions is on the rise. By 2025, it is projected that investments in secure optical networks will account for approximately 30% of total spending in the telecommunications sector. This trend is likely to drive innovation in optical transport technologies, as providers seek to integrate advanced security features such as encryption and intrusion detection. Consequently, the emphasis on network security is expected to play a crucial role in shaping the optical transport-network market, ensuring that it meets the evolving needs of businesses and consumers alike.

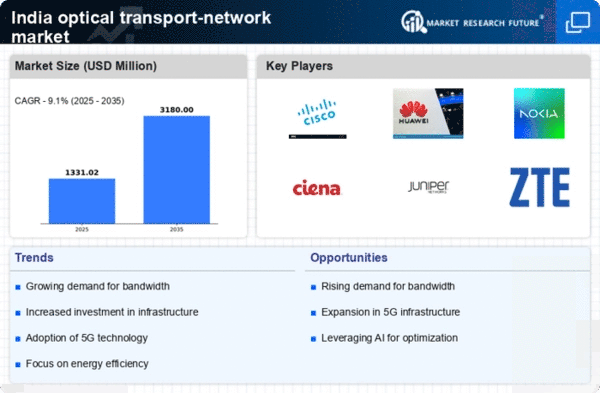

Emergence of 5G Technology

The rollout of 5G technology in India is poised to have a profound impact on the optical transport-network market. With the anticipated launch of 5G services, which promise data speeds up to 100 times faster than 4G, the demand for high-capacity optical networks is expected to surge. As of November 2025, telecom operators are investing heavily in upgrading their infrastructure to support 5G, with estimates suggesting an investment of around $20 billion in optical transport solutions. This transition not only enhances mobile broadband services but also facilitates the development of new applications such as augmented reality and smart manufacturing, thereby driving the optical transport-network market's growth.

Increasing Internet Penetration

The optical transport-network market in India is experiencing a notable boost due to the increasing penetration of the internet across urban and rural areas. As of 2025, internet penetration in India stands at approximately 70%, with projections indicating further growth. This surge in connectivity necessitates robust optical transport networks to handle the escalating data traffic. The demand for high-speed internet services, driven by the proliferation of digital platforms and online services, is compelling telecom operators to invest in advanced optical transport solutions. Consequently, this trend is likely to enhance the optical transport-network market, as service providers seek to upgrade their infrastructure to meet consumer expectations for faster and more reliable internet access.

Rising Adoption of Cloud Services

The optical transport-network market is being propelled by the rising adoption of cloud services among businesses in India. As organizations increasingly migrate to cloud-based solutions, the demand for high-capacity, low-latency networks becomes critical. By 2025, it is estimated that over 60% of Indian enterprises will utilize cloud services, necessitating the deployment of optical transport networks to ensure seamless data flow. This shift towards cloud computing is likely to create substantial opportunities for optical transport solutions, as they provide the necessary bandwidth and reliability to support diverse applications, from data storage to software as a service (SaaS). Consequently, the optical transport-network market is expected to witness robust growth driven by this trend.