Regulatory Support for MVNO Operations

Regulatory support is a crucial driver for the mobile virtual-network-operator market in India. The government has implemented policies aimed at promoting competition and enhancing consumer choice in the telecommunications sector. Recent regulatory frameworks have facilitated easier entry for MVNOs, allowing them to operate with greater flexibility. This supportive environment is reflected in the increasing number of MVNO licenses issued, which has grown by 25% over the past two years. Such regulatory measures not only encourage new players to enter the market but also stimulate innovation among existing operators. As a result, the mobile virtual-network-operator market is likely to benefit from a more diverse range of services and competitive pricing, ultimately enhancing consumer satisfaction.

Rising Demand for Affordable Connectivity

The mobile virtual-network-operator market in India experiences a notable surge in demand for affordable connectivity solutions. With a significant portion of the population seeking cost-effective mobile services, MVNOs are positioned to cater to this need. The market data indicates that approximately 60% of Indian consumers prioritize price over other factors when selecting mobile services. This trend compels MVNOs to offer competitive pricing models, thereby enhancing their market presence. As a result, the mobile virtual-network-operator market is likely to witness an influx of new entrants aiming to capture this price-sensitive segment. Furthermore, the increasing penetration of smartphones and internet access in rural areas further fuels this demand, suggesting a robust growth trajectory for MVNOs in the coming years.

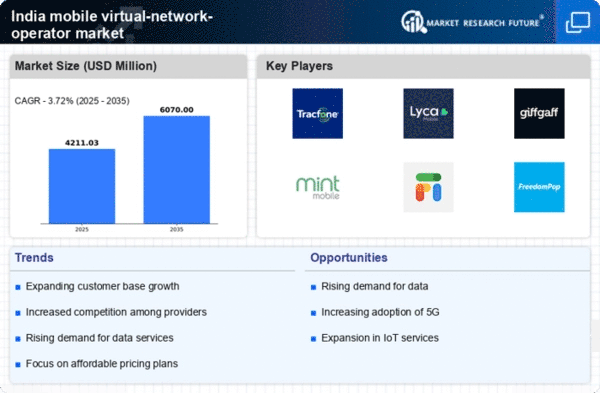

Increased Competition Among Telecom Providers

Increased competition among telecom providers serves as a significant driver for the mobile virtual-network-operator market in India. The entry of new players and the aggressive strategies of existing operators create a dynamic environment that benefits consumers. Market data suggests that the number of active mobile subscriptions in India has surpassed 1.2 billion, intensifying the competition for market share. MVNOs are compelled to differentiate themselves through innovative service offerings and competitive pricing to attract customers. This competitive landscape not only drives down prices but also encourages the development of unique value propositions, such as niche services targeting specific demographics. As a result, the mobile virtual-network-operator market is likely to witness sustained growth, fueled by the ongoing rivalry among telecom providers.

Shift Towards Digital Services and E-commerce

The shift towards digital services and e-commerce significantly influences the mobile virtual-network-operator market in India. As consumers increasingly rely on digital platforms for various services, MVNOs are adapting their offerings to align with this trend. The market data indicates that over 70% of Indian consumers engage in online shopping, creating opportunities for MVNOs to bundle mobile services with e-commerce solutions. This integration not only enhances customer value but also fosters brand loyalty. Furthermore, the rise of digital payment systems and mobile wallets complements this trend, as MVNOs can leverage these technologies to provide seamless payment solutions. Consequently, the mobile virtual-network-operator market is poised for growth as it embraces the digital transformation sweeping across various sectors.

Technological Advancements in Network Infrastructure

Technological advancements play a pivotal role in shaping the mobile virtual-network-operator market in India. The ongoing evolution of network infrastructure, particularly with the rollout of 5G technology, presents new opportunities for MVNOs. Enhanced network capabilities enable MVNOs to offer superior data services and innovative solutions, potentially attracting a broader customer base. Market data reveals that the adoption of 5G is expected to reach 30% of mobile subscriptions in India by 2026, indicating a significant shift in consumer expectations. This technological shift compels MVNOs to adapt and innovate, ensuring they remain competitive in a rapidly evolving landscape. Consequently, the mobile virtual-network-operator market is likely to experience increased investment in infrastructure and service diversification, fostering a more dynamic competitive environment.