Rising Demand for Flexible Plans

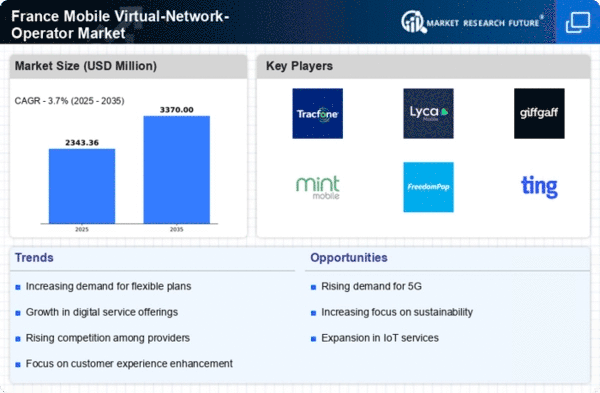

The Mobile Virtual-Network-Operator Market. in France experiences a notable increase in demand for flexible and customizable mobile plans. Consumers are increasingly seeking options that allow them to tailor their services according to their specific needs, such as data allowances and contract lengths. This trend is driven by a shift in consumer behavior towards more personalized experiences. As of 2025, approximately 35% of mobile users in France express a preference for flexible plans, indicating a significant opportunity for mobile virtual-network-operators to capture this segment. The ability to offer diverse and adaptable plans could enhance customer satisfaction and retention, thereby positively impacting the overall growth of the mobile virtual-network-operator market.

Regulatory Support for MVNO Growth

Regulatory frameworks in France are increasingly supportive of the mobile virtual-network-operator market, fostering an environment conducive to growth. The French government has implemented policies aimed at promoting competition and ensuring fair access to network infrastructure for MVNOs. This regulatory support is crucial, as it enables smaller operators to compete effectively against larger incumbents. As of November 2025, the regulatory landscape appears to be evolving positively, with initiatives aimed at reducing barriers to entry and enhancing market access for new entrants. Such measures could stimulate innovation and expansion within the mobile virtual-network-operator market, ultimately benefiting consumers through improved service offerings.

Cost-Effectiveness of MVNO Services

Cost considerations play a crucial role in the mobile virtual-network-operator market in France. MVNOs typically offer competitive pricing compared to traditional mobile network operators, which appeals to price-sensitive consumers. In 2025, the average monthly cost for MVNO services is reported to be around €20, significantly lower than the €30 average for major carriers. This price advantage allows MVNOs to attract a broader customer base, particularly among younger demographics and those seeking budget-friendly options. The cost-effectiveness of MVNO services is likely to drive market growth, as consumers increasingly prioritize value for money in their mobile service choices.

Growing Trend of Digital Services Integration

The integration of digital services into mobile offerings is becoming increasingly prevalent in the mobile virtual-network-operator market in France. MVNOs are beginning to bundle services such as streaming, cloud storage, and mobile payments with their mobile plans. This trend aligns with consumer preferences for comprehensive service packages that enhance the overall value proposition. As of 2025, around 25% of MVNO customers in France utilize bundled services, indicating a growing acceptance of this model. By offering integrated digital services, MVNOs can differentiate themselves in a competitive landscape, potentially driving customer acquisition and retention in the mobile virtual-network-operator market.

Technological Advancements in Network Infrastructure

The mobile virtual-network-operator market in France is poised to benefit from ongoing technological advancements in network infrastructure. The rollout of 5G technology is expected to enhance service quality and expand coverage, providing MVNOs with the opportunity to offer faster and more reliable services. As of November 2025, it is estimated that 5G coverage in urban areas of France reaches approximately 70%, enabling MVNOs to leverage this infrastructure to improve their offerings. This technological evolution may lead to increased competition among operators, as enhanced capabilities could attract more customers to the mobile virtual-network-operator market.