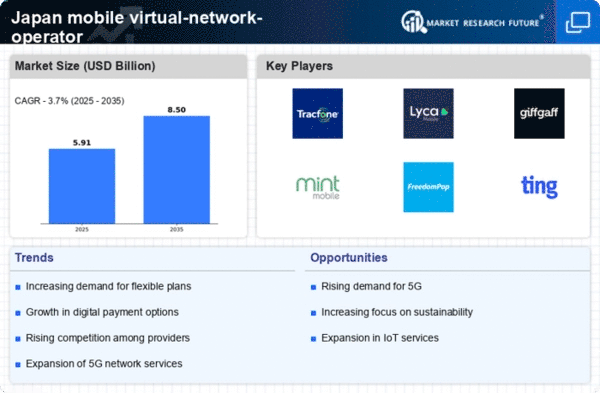

Rising Demand for Flexible Plans

The mobile virtual-network-operator market in Japan experiences a notable increase in demand for flexible mobile plans. Consumers are increasingly seeking options that allow them to customize their services according to their specific needs. This trend is driven by a shift in consumer behavior, where individuals prefer to avoid long-term contracts and opt for pay-as-you-go or month-to-month plans. As of 2025, approximately 30% of mobile users in Japan have switched to flexible plans, indicating a significant market shift. This demand for flexibility is likely to encourage more MVNOs to enter the market, thereby intensifying competition and potentially leading to better pricing and service offerings.

Regulatory Support for MVNO Growth

The mobile virtual-network-operator market in Japan benefits from supportive regulatory frameworks that encourage the growth of MVNOs. The Japanese government has implemented policies aimed at fostering competition in the telecommunications sector, which includes measures to facilitate easier market entry for new operators. As a result, MVNOs are able to negotiate favorable agreements with major network operators, allowing them to offer competitive pricing and services. This regulatory environment is expected to continue promoting the expansion of the mobile virtual-network-operator market, as it creates a more level playing field for both established and new entrants.

Consumer Preference for Value-Added Services

The mobile virtual-network-operator market in Japan is increasingly shaped by consumer preferences for value-added services. Customers are not only looking for basic mobile connectivity but also for additional features such as data rollover, international calling, and bundled entertainment options. As of November 2025, surveys indicate that nearly 40% of consumers prioritize these value-added services when selecting their mobile provider. This trend suggests that MVNOs that can effectively differentiate themselves through unique service offerings may gain a competitive edge in the market, thereby driving growth and customer loyalty.

Increased Competition Among Service Providers

The mobile virtual-network-operator market in Japan is characterized by heightened competition among service providers. With the entry of new MVNOs, the market landscape is becoming increasingly crowded. This competition is driving innovation and leading to more attractive pricing strategies. As of 2025, the number of MVNOs operating in Japan has surged to over 100, resulting in a diverse range of service offerings. This competitive environment is likely to benefit consumers, as they can choose from a variety of plans and services that cater to their preferences, ultimately enhancing customer satisfaction in the mobile virtual-network-operator market.

Technological Advancements in Network Infrastructure

The mobile virtual-network-operator market in Japan is significantly influenced by advancements in network infrastructure technology. The rollout of 5G networks has created new opportunities for MVNOs to offer enhanced services, such as higher data speeds and improved connectivity. As of November 2025, it is estimated that 5G coverage in urban areas of Japan has reached approximately 80%, allowing MVNOs to leverage this technology to attract customers. Furthermore, the integration of IoT devices into mobile services is expected to expand the market, as MVNOs can provide tailored solutions for various sectors, including healthcare and smart cities.