Advancements in Biomarker Discovery

Recent advancements in biomarker discovery are significantly influencing the liquid biopsy market in India. The identification of novel biomarkers has enhanced the ability to detect various cancers at earlier stages, which is crucial for effective treatment. This progress is likely to lead to an increase in the adoption of liquid biopsies, as they can provide real-time insights into tumor dynamics. The liquid biopsy market is expected to see a substantial increase in revenue, with estimates suggesting a rise to $500 million by 2027. This growth is indicative of the potential for liquid biopsies to revolutionize cancer diagnostics and patient management.

Growing Demand for Non-Invasive Diagnostics

The liquid biopsy market in India is experiencing a surge in demand for non-invasive diagnostic methods. Patients and healthcare providers are increasingly favoring liquid biopsies due to their ability to provide critical information with minimal discomfort. This shift is particularly evident in oncology, where traditional tissue biopsies can be invasive and painful. The liquid biopsy market is projected to grow at a CAGR of approximately 20% over the next five years, driven by the need for early cancer detection and monitoring. As awareness of these benefits spreads, more healthcare facilities are adopting liquid biopsy technologies, thereby expanding the market's reach and accessibility.

Supportive Government Policies and Initiatives

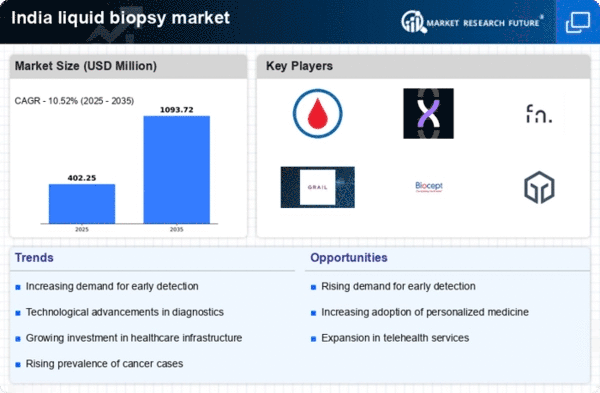

Supportive government policies and initiatives are playing a crucial role in the growth of the liquid biopsy market in India. The government is actively promoting the adoption of advanced diagnostic technologies through funding and regulatory support. Initiatives aimed at enhancing healthcare infrastructure and accessibility are likely to facilitate the integration of liquid biopsy technologies into routine clinical practice. The liquid biopsy market stands to benefit from these favorable conditions, as increased government backing can lead to accelerated market growth. With ongoing support, the market may experience a robust expansion, potentially doubling in size within the next decade.

Rising Awareness Among Healthcare Professionals

There is a growing awareness among healthcare professionals regarding the benefits of liquid biopsies in cancer diagnostics. Educational initiatives and training programs are being implemented to inform clinicians about the advantages of using liquid biopsies over traditional methods. This increased knowledge is likely to drive the adoption of liquid biopsy technologies in clinical practice. The liquid biopsy market is poised for growth as more healthcare providers recognize the potential for improved patient outcomes. As awareness continues to rise, the market could see a significant uptick in usage, contributing to an overall increase in diagnostic efficiency.

Increased Investment in Research and Development

Investment in research and development (R&D) is a key driver for the liquid biopsy market in India. Both public and private sectors are channeling funds into innovative technologies that enhance the accuracy and reliability of liquid biopsies. This influx of capital is fostering collaborations between academic institutions and biotech companies, leading to the development of cutting-edge solutions. The liquid biopsy market is likely to benefit from these advancements, as improved technologies can lead to higher adoption rates among healthcare providers. As R&D continues to flourish, the market is expected to expand, potentially reaching a valuation of $1 billion by 2030.