Rising Incidence of Cancer

The increasing incidence of cancer in South Korea is a pivotal driver for the liquid biopsy market. With cancer being one of the leading causes of mortality, the demand for early detection and monitoring solutions is surging. Liquid biopsies offer a non-invasive alternative to traditional tissue biopsies, enabling timely diagnosis and treatment adjustments. According to recent statistics, cancer cases in South Korea are projected to rise by approximately 3.5% annually, which underscores the urgent need for innovative diagnostic tools. This trend is likely to propel the liquid biopsy market forward, as healthcare providers seek efficient methods to manage cancer care. The liquid biopsy market is thus positioned to benefit from this growing patient population, as it aligns with the healthcare system's focus on improving patient outcomes through advanced diagnostic technologies.

Advancements in Genomic Technologies

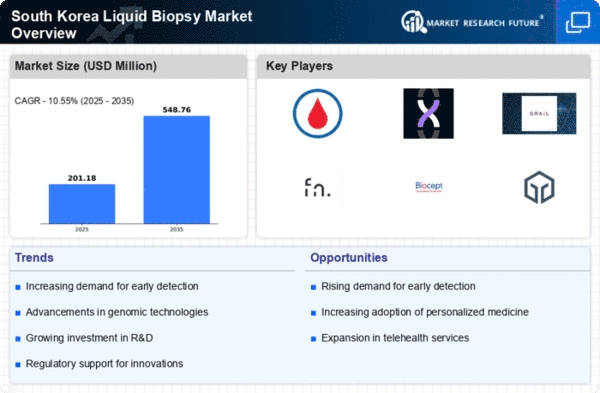

Technological innovations in genomic sequencing and analysis are significantly influencing the liquid biopsy market. The advent of next-generation sequencing (NGS) has enhanced the sensitivity and specificity of liquid biopsies, allowing for the detection of minimal residual disease and genetic mutations. In South Korea, the integration of these advanced technologies is expected to drive market growth, as healthcare providers increasingly adopt liquid biopsy solutions for cancer diagnostics. The liquid biopsy market is witnessing a shift towards more personalized approaches, with genomic insights enabling tailored treatment plans. As the cost of genomic testing continues to decrease, it is anticipated that the adoption of liquid biopsies will expand, further solidifying their role in modern oncology practices.

Regulatory Support for Innovative Diagnostics

Regulatory support for innovative diagnostic solutions is a significant driver for the liquid biopsy market. In South Korea, regulatory bodies are increasingly recognizing the potential of liquid biopsies in transforming cancer diagnostics. Streamlined approval processes and favorable policies are encouraging the development and commercialization of liquid biopsy tests. This supportive regulatory environment is likely to enhance the liquid biopsy market, as it facilitates quicker access to cutting-edge diagnostic tools for healthcare providers. As regulations evolve to accommodate advancements in technology, the market is expected to expand, providing patients with more options for early detection and personalized treatment.

Growing Awareness Among Healthcare Professionals

The increasing awareness and education among healthcare professionals regarding the benefits of liquid biopsies are driving market growth. As clinicians become more informed about the advantages of non-invasive testing methods, the adoption of liquid biopsy solutions is likely to rise. In South Korea, educational programs and workshops are being implemented to enhance understanding of liquid biopsy applications in oncology. This trend is expected to foster greater acceptance of liquid biopsies in clinical practice, thereby expanding the liquid biopsy market. Enhanced knowledge among healthcare providers may lead to improved patient outcomes, as timely and accurate diagnostics become more accessible.

Increased Investment in Research and Development

Investment in research and development (R&D) within the liquid biopsy market is a crucial driver of growth. South Korea's commitment to advancing healthcare technologies has led to substantial funding for innovative diagnostic solutions. Government initiatives and private sector investments are fostering an environment conducive to the development of novel liquid biopsy tests. This influx of capital is likely to accelerate the introduction of new products and technologies, enhancing the overall capabilities of the liquid biopsy market. As R&D efforts continue to evolve, the market is expected to witness a surge in innovative applications, including the detection of various cancers and other diseases, thereby expanding its reach and impact.