Rising Incidence of Cancer

The rising incidence of cancer globally is a primary driver for the In Vitro Diagnostic Liquid Biopsy Testing Market. As cancer rates continue to escalate, the need for effective and timely diagnostic solutions becomes increasingly urgent. Liquid biopsies offer a promising alternative to traditional methods, allowing for earlier detection and better monitoring of treatment responses. According to recent statistics, cancer cases are expected to rise by approximately 70% over the next two decades, which could significantly increase the demand for liquid biopsy tests. This growing patient population presents a substantial opportunity for market players to innovate and expand their offerings in the liquid biopsy space.

Regulatory Support and Approvals

Regulatory bodies are playing a crucial role in the In Vitro Diagnostic Liquid Biopsy Testing Market by providing clear guidelines and expedited approval processes for innovative diagnostic tests. The support from agencies such as the FDA and EMA is fostering an environment conducive to the development and commercialization of liquid biopsy technologies. Recent approvals of liquid biopsy tests for various cancers have bolstered confidence among manufacturers and healthcare providers. This regulatory backing is expected to enhance market growth, as it encourages investment in research and development. The increasing number of approved tests is likely to expand the market, making liquid biopsies a standard practice in oncology.

Growing Demand for Non-Invasive Testing

There is a notable increase in the demand for non-invasive testing methods within the In Vitro Diagnostic Liquid Biopsy Testing Market. Patients and healthcare providers are increasingly favoring liquid biopsies due to their ability to minimize discomfort and risk associated with traditional biopsies. This shift in preference is driven by the growing awareness of the benefits of early cancer detection and monitoring. Market data indicates that the liquid biopsy segment is expected to capture a significant share of the overall diagnostic market, with projections suggesting it could account for over 30% of the oncology diagnostics market by 2027. This trend underscores the potential for liquid biopsies to become a cornerstone in cancer management.

Increased Investment in Cancer Research

Investment in cancer research is surging, which is positively impacting the In Vitro Diagnostic Liquid Biopsy Testing Market. Governments, private organizations, and pharmaceutical companies are allocating substantial resources to develop advanced diagnostic tools, including liquid biopsies. This influx of funding is facilitating the exploration of new biomarkers and technologies that enhance the capabilities of liquid biopsies. As research progresses, the potential for liquid biopsies to provide comprehensive insights into tumor dynamics and treatment efficacy is becoming clearer. The anticipated growth in research funding is likely to accelerate the adoption of liquid biopsy technologies, further propelling market growth.

Technological Advancements in Liquid Biopsy Testing

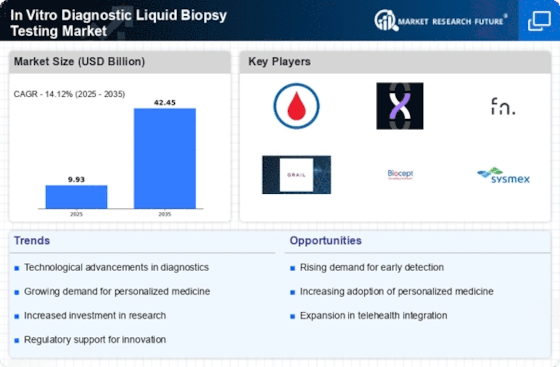

The In Vitro Diagnostic Liquid Biopsy Testing Market is experiencing rapid technological advancements that enhance the accuracy and efficiency of cancer detection. Innovations in next-generation sequencing (NGS) and digital PCR are enabling the identification of circulating tumor DNA (ctDNA) with unprecedented sensitivity. These advancements are not only improving diagnostic capabilities but also facilitating the development of personalized treatment plans. The market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. As technology continues to evolve, the potential for liquid biopsies to replace traditional tissue biopsies becomes increasingly viable, thereby driving market expansion.