Increasing Cybersecurity Threats

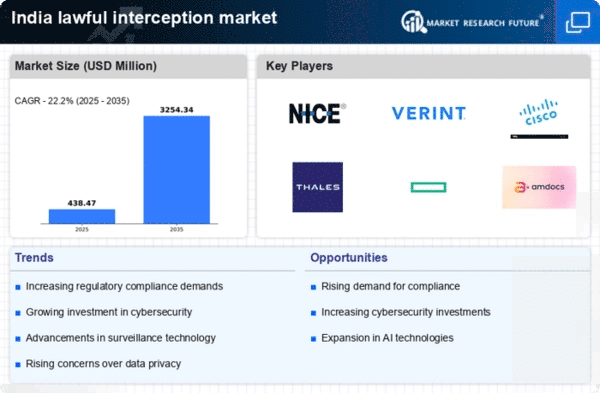

The rise in cybersecurity threats in India has led to a heightened focus on the lawful interception market. As cybercrime becomes more sophisticated, law enforcement agencies require advanced tools to monitor and intercept communications for investigative purposes. The Indian government has recognized the need for robust interception capabilities to combat these threats, which has resulted in increased investments in technology. Reports indicate that the lawful interception market is projected to grow at a CAGR of 15% over the next five years, driven by the necessity to safeguard national security and public safety. This trend underscores the importance of developing effective interception solutions that can adapt to evolving cyber threats, thereby enhancing the capabilities of law enforcement agencies in India.

Government Initiatives and Policies

The Indian government has implemented various initiatives aimed at strengthening the lawful interception market. Policies such as the National Cyber Security Policy and the Information Technology Act have established frameworks for lawful surveillance and interception. These initiatives are designed to ensure that law enforcement agencies have the necessary tools to monitor communications effectively while adhering to legal standards. The government's commitment to enhancing cybersecurity infrastructure is evident, with an estimated budget allocation of $1 billion for cybersecurity measures in the upcoming fiscal year. This financial support is likely to stimulate growth in the lawful interception market, as it encourages the development and deployment of advanced interception technologies that comply with regulatory requirements.

Public Awareness and Privacy Concerns

Public awareness regarding privacy and data protection is influencing the lawful interception market in India. As citizens become more informed about their rights, there is a growing demand for transparency in surveillance practices. This awareness has prompted discussions around the balance between security and privacy, leading to calls for stricter regulations governing lawful interception. The lawful interception market must navigate these concerns while ensuring compliance with legal frameworks. Companies operating in this space are likely to invest in developing solutions that prioritize user privacy while still providing law enforcement with the necessary tools for effective surveillance. This dynamic could shape the future landscape of the lawful interception market, as stakeholders seek to address public concerns while fulfilling security obligations.

Rising Mobile and Internet Penetration

The rapid increase in mobile and internet penetration in India has created a vast landscape for the lawful interception market. With over 800 million internet users and a mobile subscriber base exceeding 1 billion, the volume of digital communications has surged. This growth presents both opportunities and challenges for law enforcement agencies, necessitating effective interception solutions to monitor and analyze communications. The lawful interception market is expected to benefit from this trend, as service providers and technology vendors develop innovative solutions to meet the demands of a connected population. The market's expansion is anticipated to be fueled by the need for compliance with regulatory requirements and the growing emphasis on public safety.

Technological Innovations in Surveillance

Technological innovations play a crucial role in shaping the lawful interception market in India. Advancements in artificial intelligence, machine learning, and big data analytics are transforming the way law enforcement agencies conduct surveillance and interception. These technologies enable the processing of vast amounts of data, allowing for more efficient monitoring of communications. As a result, the lawful interception market is likely to see increased adoption of sophisticated tools that enhance the capabilities of law enforcement. The integration of these technologies is expected to improve the accuracy and speed of interception processes, thereby supporting the efforts of agencies in maintaining public safety and national security.