Growing Cybersecurity Threats

The increasing frequency and sophistication of cyber threats in India is a primary driver for the identity analytics market. Organizations are compelled to adopt advanced identity analytics solutions to safeguard sensitive data and ensure compliance with regulations. In 2025, the cybersecurity market in India is projected to reach approximately $13 billion, reflecting a compound annual growth rate (CAGR) of around 15%. This surge in cybersecurity investments indicates a heightened awareness of identity-related risks, prompting businesses to leverage identity analytics for proactive threat detection and response. The identity analytics market is thus positioned to benefit from this escalating demand for robust security measures, as organizations seek to mitigate potential breaches and protect their digital assets.

Growing Awareness of Data Privacy

The increasing awareness of data privacy among consumers and businesses in India is a significant driver for the identity analytics market. As individuals become more conscious of their personal information and its security, organizations are compelled to adopt identity analytics solutions to enhance transparency and trust. Surveys indicate that over 70% of Indian consumers are concerned about data privacy, prompting businesses to prioritize identity management strategies. This heightened awareness is likely to drive investments in identity analytics technologies, as organizations seek to demonstrate their commitment to protecting customer data. The identity analytics market is expected to benefit from this trend, as companies implement solutions that align with consumer expectations and regulatory requirements.

Regulatory Framework Enhancements

The evolving regulatory landscape in India significantly influences the identity analytics market. With the introduction of stringent data protection laws, organizations are increasingly required to implement comprehensive identity management solutions. The Personal Data Protection Bill, which is anticipated to be enacted, mandates organizations to ensure the security and privacy of personal data. This regulatory pressure drives the adoption of identity analytics solutions, as businesses strive to comply with legal requirements while minimizing risks associated with data breaches. The identity analytics market is likely to experience growth as companies invest in technologies that facilitate compliance, thereby enhancing their operational integrity and customer trust.

Digital Transformation Initiatives

India's ongoing digital transformation initiatives are a crucial driver for the identity analytics market. As businesses across various sectors embrace digital technologies, the need for effective identity management becomes paramount. The government’s push for digitalization, including initiatives like Digital India, encourages organizations to adopt advanced identity analytics solutions to streamline operations and enhance customer experiences. In 2025, the digital economy in India is expected to contribute over $1 trillion to the GDP, underscoring the importance of secure identity management in this rapidly evolving landscape. The identity analytics market stands to gain from this trend, as organizations seek to leverage analytics for improved identity verification and fraud prevention.

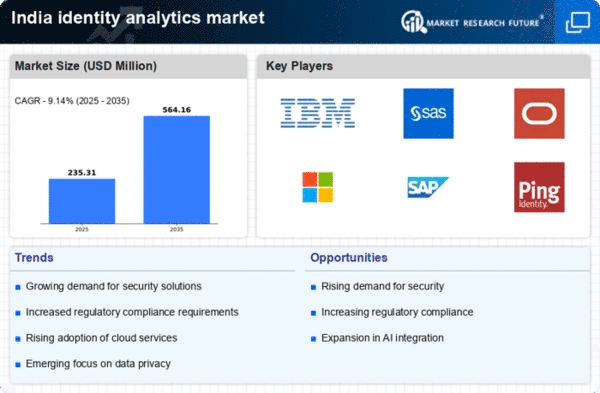

Increased Adoption of Cloud Services

The rising adoption of cloud services in India is significantly impacting the identity analytics market. As organizations migrate to cloud-based platforms, the need for robust identity and access management solutions becomes critical. Cloud environments present unique challenges related to identity security, necessitating advanced analytics to monitor and manage user identities effectively. The cloud services market in India is projected to grow to $10 billion by 2025, indicating a strong demand for identity analytics solutions that can seamlessly integrate with cloud infrastructures. The identity analytics market is likely to thrive as businesses prioritize security and compliance in their cloud strategies, driving investments in identity analytics technologies.