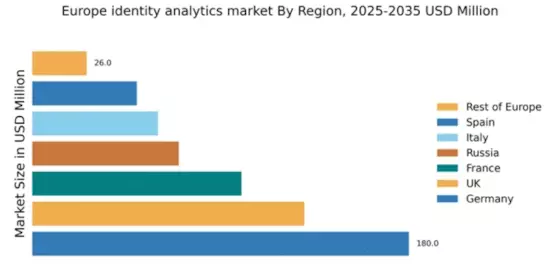

Germany : Strong Growth Driven by Innovation

Germany holds a dominant position in the European identity analytics market, with a market value of $180.0 million, representing approximately 30% of the total market share. Key growth drivers include a robust digital transformation agenda, increasing cybersecurity threats, and a strong emphasis on data protection regulations like the GDPR. The government has initiated various programs to enhance digital infrastructure, fostering a conducive environment for technology adoption and innovation.

UK : Innovation and Regulation Drive Growth

Key markets include London and Manchester, where major financial institutions and tech companies are concentrated. The competitive landscape features significant players like IBM and Microsoft, alongside local startups. The business environment is dynamic, with a focus on fintech and healthcare sectors, driving the adoption of identity analytics solutions.

France : Strong Regulatory Frameworks Support Market

Key cities like Paris and Lyon are central to market activities, hosting numerous tech firms and startups. The competitive landscape includes major players like Oracle and SAP, which have established a strong presence. The local market dynamics favor sectors such as banking and telecommunications, where identity analytics applications are increasingly adopted.

Russia : Growing Demand Amidst Regulatory Changes

Key markets include Moscow and St. Petersburg, where the concentration of tech companies is high. The competitive landscape features both local and international players, with companies like Ping Identity gaining traction. The business environment is evolving, with a focus on digital transformation across industries, leading to increased adoption of identity analytics.

Italy : Focus on Compliance and Security

Key markets include Milan and Rome, where many financial and retail companies are based. The competitive landscape features major players like Microsoft and Oracle, alongside local firms. The business environment is supportive of innovation, particularly in sectors such as retail and finance, where identity analytics solutions are increasingly utilized.

Spain : Digital Transformation Fuels Demand

Key markets include Madrid and Barcelona, where a mix of tech startups and established companies operate. The competitive landscape includes major players like IBM and SAP, which are well-positioned in the market. The local business environment is dynamic, with a focus on sectors such as public administration and healthcare, driving the adoption of identity analytics solutions.

Rest of Europe : Diverse Regulations Shape Landscape

Key markets include smaller countries like Belgium and the Netherlands, where local players are emerging. The competitive landscape is fragmented, with a mix of local and international firms. The business environment varies significantly, with some countries focusing on specific sectors like finance or healthcare, leading to tailored identity analytics solutions.