Rising Consumer Awareness

Consumer awareness regarding data privacy and security is on the rise in South America. As individuals become more informed about their rights and the potential risks associated with data breaches, they are demanding greater transparency from organizations. This shift in consumer behavior is influencing the identity analytics market, as businesses are compelled to adopt solutions that enhance data protection and build trust. Companies that prioritize identity analytics are likely to gain a competitive edge, as they can demonstrate their commitment to safeguarding customer information. By 2025, it is anticipated that organizations focusing on consumer trust will see a 15% increase in customer retention rates, further driving the adoption of identity analytics solutions.

Growing Cybersecurity Threats

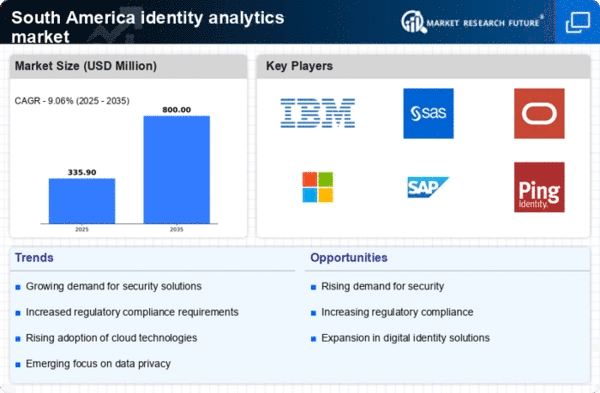

The increasing frequency and sophistication of cyberattacks in South America has heightened the need for robust identity analytics solutions. Organizations are recognizing that traditional security measures are insufficient against evolving threats. As a result, the identity analytics market is experiencing a surge in demand for advanced analytics tools that can detect anomalies and prevent unauthorized access. In 2025, it is estimated that cybersecurity spending in the region will reach approximately $20 billion, with a significant portion allocated to identity management solutions. This trend indicates a strong market driver, as businesses seek to protect sensitive data and maintain customer trust in an increasingly digital landscape.

Regulatory Landscape Evolution

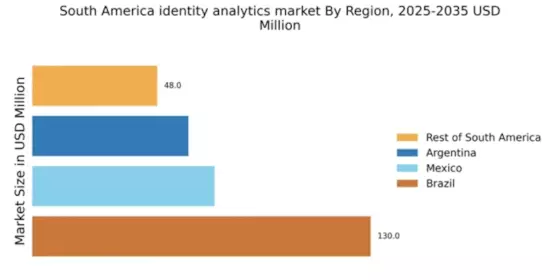

The regulatory environment in South America is evolving, with governments implementing stricter data protection laws. This shift compels organizations to adopt identity analytics solutions to ensure compliance with regulations such as the General Data Protection Law (LGPD) in Brazil. The identity analytics market is likely to benefit from this trend, as companies invest in technologies that facilitate compliance and mitigate legal risks. By 2025, it is projected that compliance-related expenditures will account for over 30% of total IT budgets in the region. This regulatory pressure serves as a significant driver for the adoption of identity analytics tools, as organizations strive to avoid penalties and enhance their data governance frameworks.

Technological Advancements in AI and ML

The rapid advancements in artificial intelligence (AI) and machine learning (ML) technologies are transforming the identity analytics market in South America. These technologies enable organizations to analyze vast amounts of data in real-time, improving the accuracy of identity verification processes. As AI and ML become more integrated into identity analytics solutions, businesses are likely to experience enhanced fraud detection capabilities and streamlined operations. By 2025, it is expected that the AI market in South America will grow by 30%, indicating a strong potential for identity analytics solutions that leverage these technologies. This trend suggests that organizations investing in AI-driven identity analytics will be better positioned to address emerging security challenges.

Increased Digital Transformation Initiatives

As businesses in South America accelerate their digital transformation efforts, the demand for identity analytics solutions is expected to rise. Organizations are increasingly adopting cloud-based services and mobile applications, which necessitate robust identity verification processes. The identity analytics market is poised to capitalize on this trend, as companies seek to enhance user experiences while ensuring security. In 2025, the cloud services market in South America is projected to grow by 25%, further driving the need for effective identity management solutions. This digital shift indicates a growing recognition of the importance of identity analytics in safeguarding digital assets and maintaining operational integrity.