Emergence of Biosimilars

The emergence of biosimilars in India is significantly influencing the host cell-protein-testing market. As the patent expirations of several blockbuster biologics occur, the biosimilars market is expected to grow rapidly, potentially reaching $30 billion by 2025. This growth necessitates rigorous testing of host cell proteins to ensure that biosimilars are comparable to their reference products in terms of safety and efficacy. Consequently, biopharmaceutical companies are increasingly investing in host cell-protein testing to validate their biosimilar products. This trend not only drives the demand for testing services but also encourages innovation in testing methodologies, thereby enhancing the overall landscape of the host cell-protein-testing market.

Rising Investment in R&D

The increasing investment in research and development (R&D) within the biopharmaceutical sector is a significant driver for the host cell-protein-testing market. Indian companies are allocating substantial resources to develop novel therapeutics, which necessitates comprehensive testing of host cell proteins. This trend is reflected in the growing number of clinical trials and the establishment of research facilities across the country. As R&D activities intensify, the demand for reliable and efficient host cell-protein testing services is likely to surge. This investment not only fosters innovation but also enhances the competitiveness of Indian biopharmaceutical firms in the global market, thereby positively impacting the host cell-protein-testing market.

Focus on Quality Assurance

Quality assurance remains a pivotal aspect of the host cell-protein-testing market in India. With the increasing scrutiny from regulatory bodies, biopharmaceutical companies are compelled to adopt stringent testing measures to ensure the purity and safety of their products. The emphasis on quality control is further amplified by the need to comply with Good Manufacturing Practices (GMP) and other regulatory guidelines. As a result, investments in advanced testing technologies and methodologies are on the rise. This focus on quality assurance not only helps in mitigating risks associated with product recalls but also enhances consumer trust in biologics. The host cell-protein-testing market is thus positioned to benefit from this heightened awareness and commitment to quality among manufacturers.

Increasing Demand for Biologics

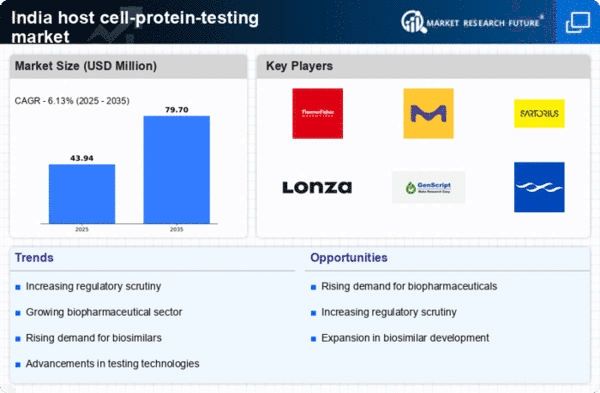

The rising demand for biologics in India is a crucial driver for the host cell-protein-testing market. As the biopharmaceutical sector expands, the need for effective testing of host cell proteins becomes paramount. This is particularly evident in the production of monoclonal antibodies and recombinant proteins, which are gaining traction in therapeutic applications. The Indian biopharmaceutical market is projected to reach $100 billion by 2025, indicating a robust growth trajectory. Consequently, the host cell-protein-testing market is likely to experience increased demand as manufacturers seek to ensure product safety and efficacy. This trend underscores the importance of rigorous testing protocols to meet both domestic and international standards, thereby enhancing the overall quality of biologics produced in India.

Collaboration with Academic Institutions

Collaboration between biopharmaceutical companies and academic institutions is emerging as a vital driver for the host cell-protein-testing market. These partnerships facilitate knowledge exchange and technological advancements, leading to improved testing methodologies. Academic institutions often engage in cutting-edge research, which can be translated into practical applications for the biopharmaceutical industry. Such collaborations are likely to enhance the capabilities of testing laboratories, ensuring that they remain at the forefront of innovation. Furthermore, these partnerships can lead to the development of specialized training programs, equipping professionals with the necessary skills to conduct host cell-protein testing effectively. This synergy between academia and industry is expected to bolster the host cell-protein-testing market in India.