Growing Awareness of Product Safety

The growing awareness of product safety among consumers and healthcare professionals is a pivotal driver of the Host Cell Protein Testing Market. As patients become more informed about the potential risks associated with biopharmaceuticals, there is an increasing demand for transparency and assurance regarding product safety. This heightened awareness is prompting biopharmaceutical companies to prioritize host cell protein testing as part of their quality assurance processes. In 2025, it is anticipated that the focus on safety and efficacy will lead to a greater emphasis on comprehensive testing protocols. Companies that can effectively communicate their commitment to safety through rigorous host cell protein testing are likely to enhance their market position, thereby contributing to the overall growth of the testing market.

Regulatory Pressures and Compliance

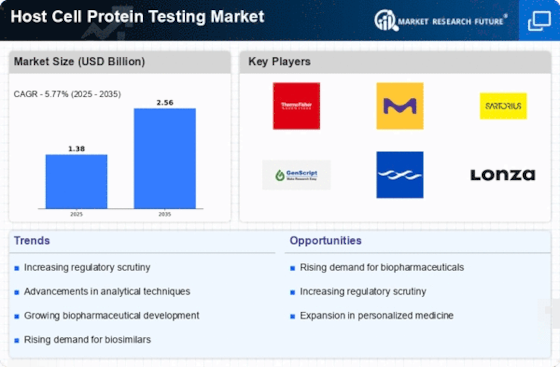

Regulatory pressures play a crucial role in shaping the Host Cell Protein Testing Market. Regulatory agencies, such as the FDA and EMA, have established stringent guidelines for the testing of host cell proteins in biopharmaceutical products. Compliance with these regulations is essential for market approval and product safety. In 2025, the emphasis on regulatory compliance is expected to intensify, as more biopharmaceutical companies seek to enter the market. This trend is likely to drive the demand for reliable and efficient host cell protein testing solutions. Companies that can demonstrate adherence to regulatory standards through robust testing protocols will likely gain a competitive advantage, thereby fueling the growth of the host cell protein testing market.

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is a primary driver of the Host Cell Protein Testing Market. As the biopharmaceutical sector expands, the need for rigorous testing of host cell proteins becomes paramount to ensure product safety and efficacy. In 2025, the biopharmaceutical market is projected to reach approximately USD 500 billion, highlighting the critical role of host cell protein testing in maintaining compliance with regulatory standards. This surge in demand necessitates advanced testing methodologies to detect and quantify host cell proteins, thereby propelling the growth of the testing market. Furthermore, as more biopharmaceutical products enter the market, the emphasis on quality assurance and control intensifies, further driving the need for comprehensive host cell protein testing solutions.

Technological Innovations in Testing

Technological advancements in testing methodologies significantly influence the Host Cell Protein Testing Market. Innovations such as high-throughput screening and mass spectrometry have revolutionized the way host cell proteins are analyzed. These technologies enhance sensitivity and specificity, allowing for more accurate detection of contaminants. The market for analytical instruments used in host cell protein testing is expected to grow at a compound annual growth rate of around 8% through 2025. This growth is indicative of the increasing reliance on sophisticated testing techniques to meet the stringent requirements set forth by regulatory bodies. As technology continues to evolve, it is likely that the efficiency and effectiveness of host cell protein testing will improve, further driving market expansion.

Increased Investment in Biotech Research

The surge in investment in biotechnology research and development is a significant driver of the Host Cell Protein Testing Market. As funding for biotech initiatives increases, there is a corresponding need for comprehensive testing solutions to ensure the safety and efficacy of new products. In 2025, investments in biotech R&D are projected to exceed USD 100 billion, underscoring the importance of host cell protein testing in the development pipeline. This influx of capital not only supports the advancement of testing technologies but also encourages collaboration between research institutions and testing service providers. Consequently, the growth of the biotech sector is likely to propel the demand for host cell protein testing services, further expanding the market.